Best natural high? When you beat elite traders with cutting edge skills

What’s achievable with accrued screen time in a single instrument?

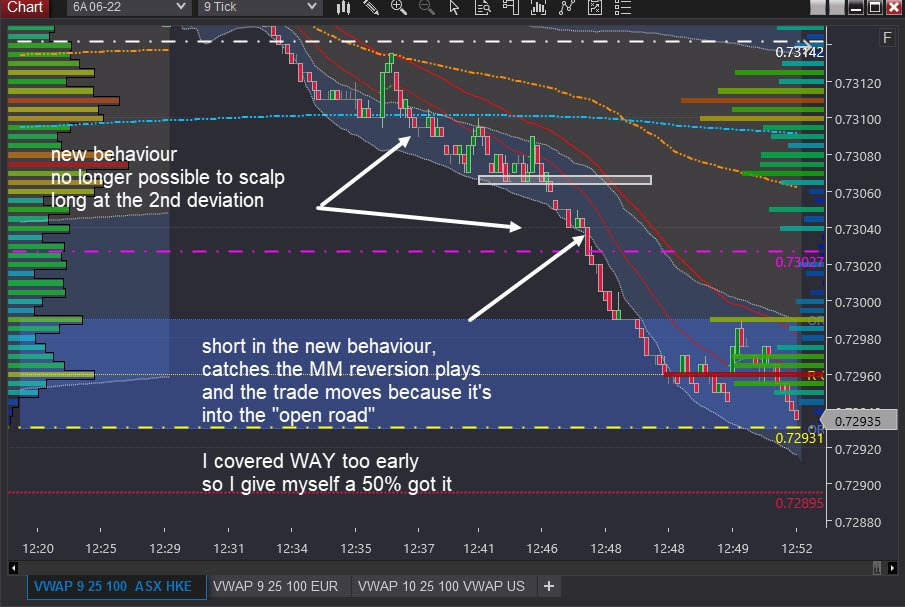

From Thursday’s intraday trading:

A once onside long trade was exited for a tight loss when the relationship between price and the second deviation of anchored VWAP changed.

Recognising other longs were yet to see the change, I flipped short to benefit from their exit order flow.

Note the red outlined 0.7325 was a "line in the sand" price level that, if unsuccessfully breached, set up downside opportunity.

An automated strategy has implemented a reversion strategy at the 2nd deviation of VWAP calculated from a secondary market.

When the market's behaviour changes, the reversion strategy reward to risk ratio inverts. The trade needs to be covered, setting up a short opportunity.

While I identified the opportunity and my entry short moved immediately onside, my exit calculation was poor, leaving way too much on the table.

The next opportunity is a play identified two days prior.

12 payouts in 3 days is an excellent return on one observation.

I go into more detail in the footage below.

Bonus!

🤜 The Footage also includes extra trades made using observation skills