Philippine Airlines banks recovery on international expansion but faces uphill battle

This is the fourth part of a series of articles on the 2013 outlook for Philippine carriers. The third part, published on 3-Apr-2013, analysed the bleak outlook in the domestic market for the Philippine Airline (PAL) Group following its decision to exit the budget sector by transitioning PAL Express, formerly known as AirPhil, from low-cost to full-service regional carrier. This part looks at the international outlook for PAL, which has improved since a determination from ICAO in Mar-2013 that the Philippine authorities are now in compliance with its safety standards.

The ICAO determination should lead to the Philippines being removed from the EU blacklist and upgraded to Category 1 status by the US FAA, opening up expansion opportunities for PAL's long-haul operation. But the ICAO determination could also lead to new competition in the Philippines to Japan, South Korea and US markets.

PAL now faces only very limited competition from other Philippine carriers to Japan and no competition from local carriers in long-haul markets. But Cebu Pacific and other Philippine LCCs plan to pursue rapid expansion of their international operations regionally and, in the case of Cebu Pacific, in the medium/long-haul market.

- The International Civil Aviation Organization (ICAO) has determined that the Philippine authorities are now in compliance with its safety standards, which should lead to the Philippines being removed from the EU blacklist and upgraded to Category 1 status by the US FAA.

- The Philippine Airlines (PAL) Group is increasing its focus on the international market following its decision to exit the budget end of the market.

- PAL's new management team is banking on growth in the international market to offset domestic declines and improve profitability.

- PAL's share of the Philippine international passenger market has been declining, with competition from other Philippine carriers, particularly Cebu Pacific, increasing.

- PAL is looking to re-launch flights to Europe, with London as the most likely initial destination, followed by Paris and Rome.

- PAL is eager to expand in the US market, but it is currently restricted by the FAA Category 2 rating.

The PAL Group is increasing its focus on the international market following its decision to exit the budget end of the market, which dominates domestic travel in the Philippines as the local population is extremely price conscious. The group's share of seat capacity in the Philippine domestic market is currently about 33%, compared to 43% in Apr-2012. PAL's new management team, which was installed after San Miguel acquired a majority stake in PAL and sister carrier AirPhil one year ago, is banking on growth in the international market to offset domestic declines.

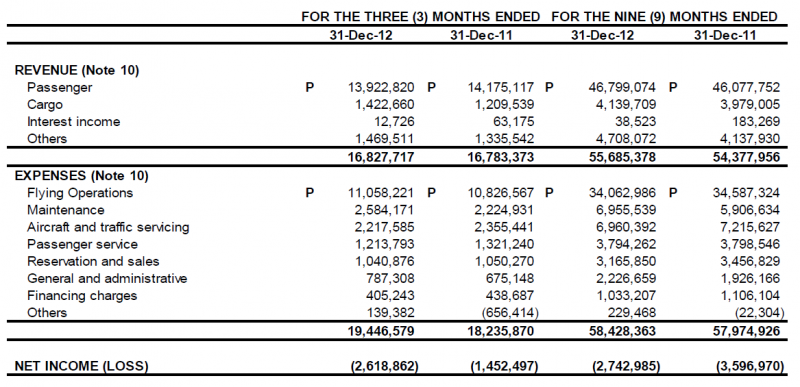

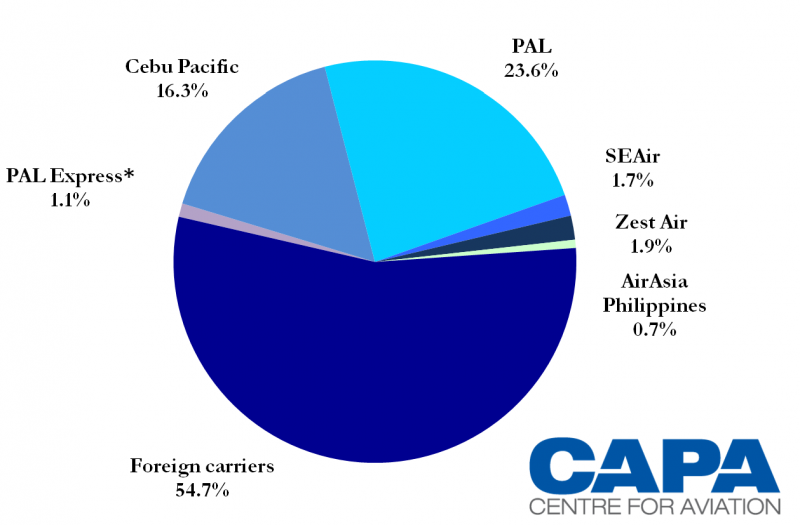

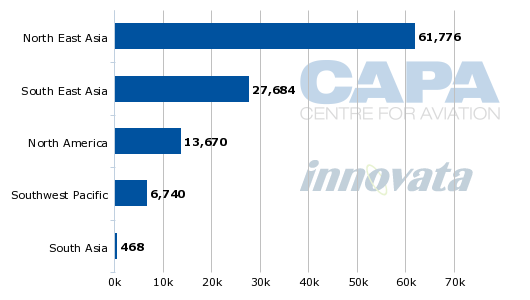

PAL is also banking on improved profitability of its international operation to lead the way back into the black. The carrier reported an 80% increase in its net loss during its most recent quarter, the three months ending 31-Dec-2012, to PHP2.62 billion (USD64 million). Its loss for the nine months ending 31-Dec-2012 was PHP2.74 billion (USD67 million). Passenger revenues for the nine months were up by only 2% as traffic declined. For the calendar year 2012, PAL's international passenger traffic increased by only 1% to just under four million while domestic passenger traffic dropped by 5% to 4.1 million.

PAL to carry more international than domestic passengers in 2013

2013 will be the first year in at least recent history that PAL carries more international passengers than domestic. According to Innovata data, 58% of the carrier's seats and 88% of its ASKs are now allocated to the international market. The portion of international flying is expected to continue to increase as PAL further increases its focus on the international market, where there is generally higher yields and less competition from LCCs.

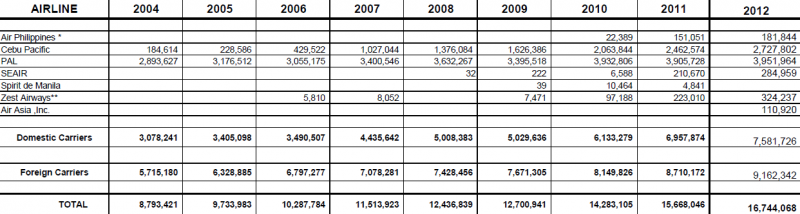

But the group's new focus entirely on the full-service end of the market could hinder its ability to expand internationally as LCCs have gradually been increasing their share of the Philippine international market. PAL has already seen its share of the Philippine international passenger market slip from 27.5% in 2010 to 24.9% in 2011 and 23.6% in 2012, according to Philippine CAB data.

PAL international market share (% of passengers carried): 2006 to 2012

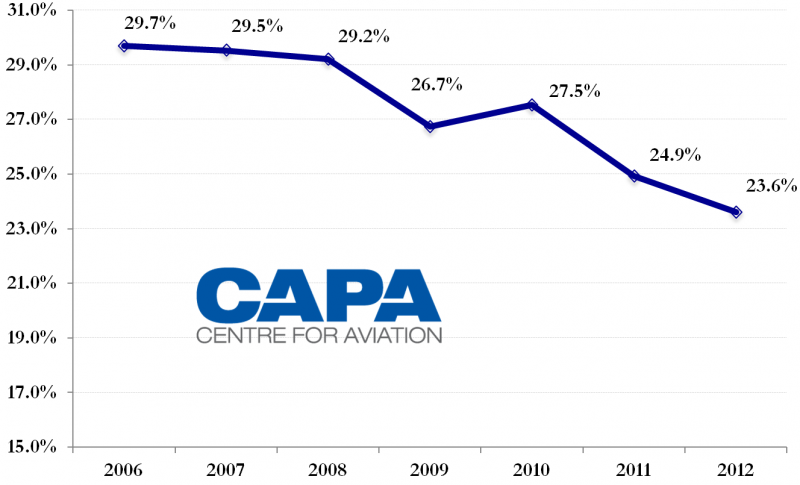

Back in 2006 PAL captured nearly 30% of the Philippine international market while Cebu Pacific captured only 2%. In 2012, Cebu's share was 16.3%, putting it 7.3ppts behind PAL. Cebu Pacific, which overtook PAL as the largest domestic carrier in 2007, will continue to close the gap with PAL as is adds regional international services and launches a long-haul unit with an initial focus on routes to the Middle East and Australia.

See related articles:

- Cebu sees bright outlook for 2013 as rationality returns to Philippines market

- Cebu Pacific's new low-cost long-haul operation to initially focus on Middle East and regional routes

Philippines international market share (% of passengers carried) by carrier: 2012

Cebu Pacific is already larger than PAL on international services within Southeast Asia. Cebu Pacific currently has a 28% share of seat capacity in the Philippines-Southeast Asia international market compared to 23% for the PAL Group, according to CAPA and Innovata data. Singapore Airlines (SIA) is even able to match PAL's 23% share when factoring in capacity from regional subsidiary SilkAir and SIA sister airline group Tiger Airways (which includes Philippine affiliate SEAir).

Philippines-Southeast Asia international capacity (seats) by carrier: 1-Apr-2013 to 7-Apr-2013

With LCCs now accounting for over 50% of capacity within Southeast Asia, the PAL Group will struggle to grow in this market without a budget subsidiary.

North Asia presents opportunities but also challenges for PAL

North Asia is now a bigger and more profitable market for PAL. North Asia accounts for 56% of the carrier's international seats compared to only 25% for Southeast Asia.

But PAL has benefitted in North Asia from restrictions on LCC growth. Some of these restrictions will be removed in 2013, leading to more intense competition for PAL in the South Korea and Japan markets.

Philippine Airlines capacity (seats) by region: 1-Apr-2013 to 7-Apr-2013

The PAL Group currently accounts for a leading 26% of capacity in the Philippine-North Asia market (includes a 1% share from PAL Express). Cebu Pacific has a 15% share while three smaller Philippine LCCs - Zest, AirAsia Philippines and Tiger affiliate SEAir - have a combined 10% share.

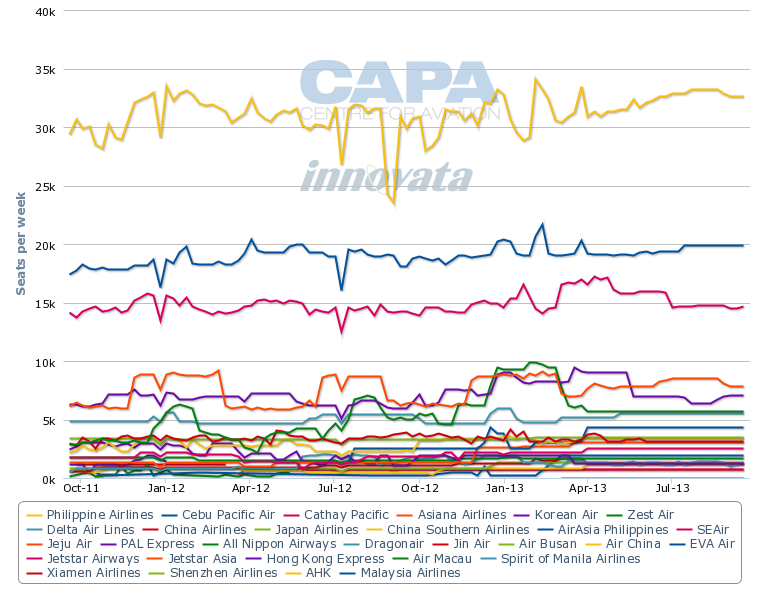

Philippines to North Asia capacity by carrier (one-way weekly seats): 19-Sep-2011 to 22-Sep-2013

Hong Kong market could see more LCC competition once bilateral is expanded

Hong Kong and South Korea are the two largest international destinations from the Philippines based on current seat capacity. The Philippines-Hong Kong market is slightly larger with nearly 40,000 weekly seats.

The PAL Group currently has a 26% share of capacity between the Philippines and Hong Kong, making it the second largest carrier in the market after Cathay Pacific (includes a 3% share from PAL Express, which operates the Cebu-Hong Kong route while PAL serves Manila-Hong Kong). Cebu Pacific currently has a 19% share of seat capacity between the Philippines and Hong Kong while AirAsia Philippines has a 5% share and SEAir a 6% share.

PAL's lead over other Philippine carriers in this market is guaranteed for now because the Hong Kong-Philippines bilateral prevents Cebu Pacific and other Philippine LCCs from expanding. For example, Cebu Pacific is unable to use its new A330 fleet on the Hong Kong route unless it swaps two A320 frequencies for an A330 flight, which it does not want to do as it wants to preserve its current schedule and slots at Hong Kong. (Cebu Pacific will instead use its first two A330s, which will be delivered in 2Q2013 and 3Q2013, to Singapore and Seoul as well as new medium-haul flights to the Middle East). But eventually the Philippine-Hong Kong bilateral will likely be extended, leading to increased LCC competition for PAL.

There are no bilateral-related restrictions on expansion to mainland China. But demand has been limited due to political tensions between China and the Philippines. Once relations improve, the market is expected to grow significantly, driven by inbound tourist demand.

LCCs are once again better positioned to tap into the expected growth given that most of China is within narrowbody range of the Philippines and the fact this market is price sensitive. PAL currently has a leading 33% share of capacity in the Philippines-China market while Cebu Pacific has a 22% share and Zest 11%.

See related article: Philippine carriers see huge opportunities in China once restrictions are lifted

Competition to South Korea and Japan to intensify in aftermath of ICAO determination

PAL is also the largest Philippine carrier in the Philippines-South Korea market, with a 15% share of total seat capacity. LCCs now account for 40% of seat capacity in the market, led by a 14% share for Cebu Pacific. The LCC share is expected to grow further as new Philippine carriers, including AirAsia Philippines, enter the market. South Korea-Philippines is a natural market for LCCs given the short duration of flights and the fact it consists primarily of budget conscious South Korean tourists.

South Korean authorities in recent years have blocked new Philippine carriers from launching services to the country. Japanese authorities have a similar ban as well as a restriction preventing Philippine carriers already serving Japan from expanding. But both countries are expected to soon remove these restrictions following the recent positive determination from ICAO, which followed an audit that was conducted in Feb-2013.

While PAL will be free to add capacity to Japan, its total share of the market will likely decrease as Philippine LCCs rapidly expand. Cebu Pacific has been limited to three weekly flights to Osaka and has indicated it will significantly add capacity to Japan as soon as the restrictions are eased.

PAL is currently the largest carrier in the Philippines-Japan market with 43% of total seat capacity while Cebu Pacific has less than a 3% share. LCCs in total account for less than 10% of the market (Jetstar Asia and Jetstar Airways also serve the Philippines-Japan market using sixth freedom rights).

PAL plans resumption of European flights

The recent ICAO determination should also lead to the removal of the Philippines from the EU blacklist. PAL is looking at re-launching flights to Europe with London the most likely initial destination, followed by Paris and Rome.

There are currently no non-stop services between the Philippines and Europe. But competition in the Philippines-Europe market is intense, with Gulf carriers and other Asian carriers offering a large range of one-stop destinations throughout Europe.

Middle Eastern carriers currently operate 47,000 weekly international seats from Manila, which equates to over 10% of total international seats from the Philippine capital. Cathay and SIA, which are the two largest foreign carriers in Manila with nearly 6% of total international seat capacity, also pick up a significant numbers of passengers heading to Europe.

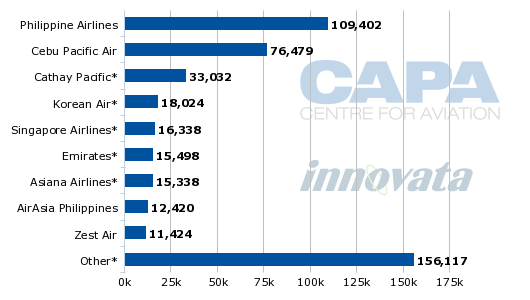

Philippines international capacity (seats) by carrier: 1-Apr-2013 to 7-Apr-2013

PAL will struggle and likely face an initial period of losses after it re-enters the European market, which could occur as early as 2H2013 assuming Philippine authorities are successful at convincing EU authorities to remove the Philippines from the blacklist when they meet in Brussels in a few weeks. PAL will need to re-establish its brand in Europe to attract inbound tourists. Winning over Filipinos working in Europe will be easier but they are spread out over several countries and PAL will need to under-cut aggressive Gulf carriers.

PAL eager to finally pursue US expansion

PAL is most looking forward to the opportunity to expand in the US, where it has been unable to grow for several years due to the Philippines coming under FAA Category 2 restrictions. Under Category 2, PAL also has been unable to deploy its new fleet of 777-300ERs on existing US routes, forcing it to continue to use inefficient 747-400s and A340s.

See related articles: Philippine Airlines plans to resume domestic expansion and looks for green light from US regulators

PAL president and San Miguel chief Ramon Ang has stated that he expects PAL will be able to narrow its losses in 2013 by about 50% by replacing 747s with 777s, reducing fuel and maintenance expenses. But PAL cannot phase out its five remaining 747s, which are used on flights to Los Angeles and San Francisco, until Philippine authorities secure a Category 1 rating from the FAA.

PAL needs to be patient as it could take several months before it gets the green light to change gauge and pursue expansion in the US market. Philippine authorities have asked the US FAA to conduct a new audit, which it will likely pass given the recent ICAO determination, but will take a few months before the audit can take place and a few more months for the results to be tallied.

The timing is crucial as PAL is slated to take the last two of its 777-300ERs in 2013. These aircraft as well as some of its original four 777-300ERs, are intended for the US market. In addition to using the 777-300ER on the Los Angeles and San Francisco routes, PAL is looking at using the type to launch services to New York and potentially a third destination on the US west coast such as San Diego. PAL is now using its 777-300ERs to Melbourne, Sydney and Tokyo - routes which are better served with A330-300s - in addition to its Manila-Vancouver-Toronto route.

PAL also serves the US islands of Guam and Hawaii with A340s and A320s respectively. But these markets will see an increase in competition as Cebu Pacific plans to enter the Manila-Guam market once Category 2 restrictions are lifted. Cebu Pacific may also consider Hawaii with its new fleet of A330s.

PAL, following the ownership change in 2012, ordered 20 additional A330-300s, which will be used to expand regional international services and replace older A330s. The carrier is now looking to acquire additional long-range twin aisle aircraft which will be used to further grow its long-haul network along with its six 777-300ERs. PAL also committed in 2012 to renewing its narrowbody fleet, which is used domestically and on regional international services, by placing orders for 44 additional A320 family aircraft.

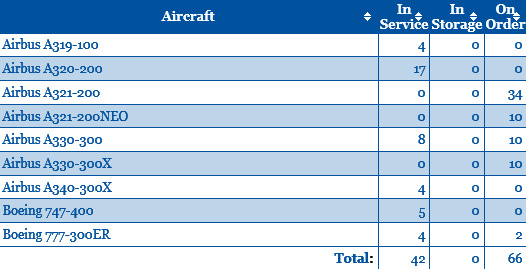

Philippine Airlines fleet summary: as of 1-Apr-2013

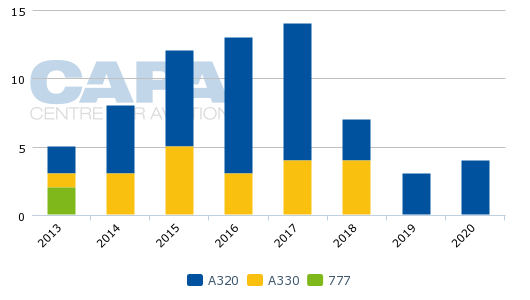

Philippine Airlines projected delivery dates for aircraft on order*: as of 1-Apr-2013

PAL to improve international product but will have to overcome competition

The fleet renewal will improve PAL's efficiency and its in-flight product, particularly in the premium market. But the Philippines does not have a large premium passenger market.

Inbound demand is mainly driven by migrant workers returning home for visits and, increasingly, tourists as the Philippines emerges as a popular holiday destination. Business passenger demand is relatively small compared to other major Southeast Asian markets. As a result it is strange that PAL has become one of only a few Asian flag carriers that lacks a budget affiliate or subsidiary and is placing its entire future on the top end of the market.

Competition in the Philippines international market will increase further as LCCs continue to expand regionally and start to open medium/long-haul routes. Gulf carriers will also be keen on further expanding in Manila, making it challenging for PAL to compete in the Philippines-Europe and Philippines-Middle East markets. There are opportunities in US market but there is also one-stop competition in this market from aggressive US and North Asian carriers.

Cathay Pacific, the largest foreign carrier serving the Philippines, is particularly strong in the Philippines to North America market. Cathay along with Korean Air and Asiana will continue to attract a large share of premium passengers heading to North Asia and North America.

PAL remains one of the weakest flag carriers in Asia in terms of network, product offering and financials. Among all the major Southeast Asian flag carriers, PAL is also the only carrier that has not yet joined, or is in the process of joining, a global alliance. This puts PAL at a competitive disadvantage as it tries to focus more on the top end of the market.

The ownership change and re-capitalisation of one year ago gave the group new energy, with the new funds being used to renew PAL's fleet and expand its international network. Toronto, which was added in late 2012, will be the first of several new long-haul destinations for the carrier, ending a period of several years of little or no growth.

But PAL remains in the red and is unlikely to return to the black in the near term. Most of the group's long-term challenges remain and competition is only getting tougher.

Background information

Philippine annual international passenger traffic by carrier: 2004 to 2012

PAL Holdings financial highlights, 3QFY2012 vs 3QFY2011 and 9MFY2012 vs 9MFY2011

Note: *later known as

Note: *later known as