NO.PZ2023040502000021

问题如下:

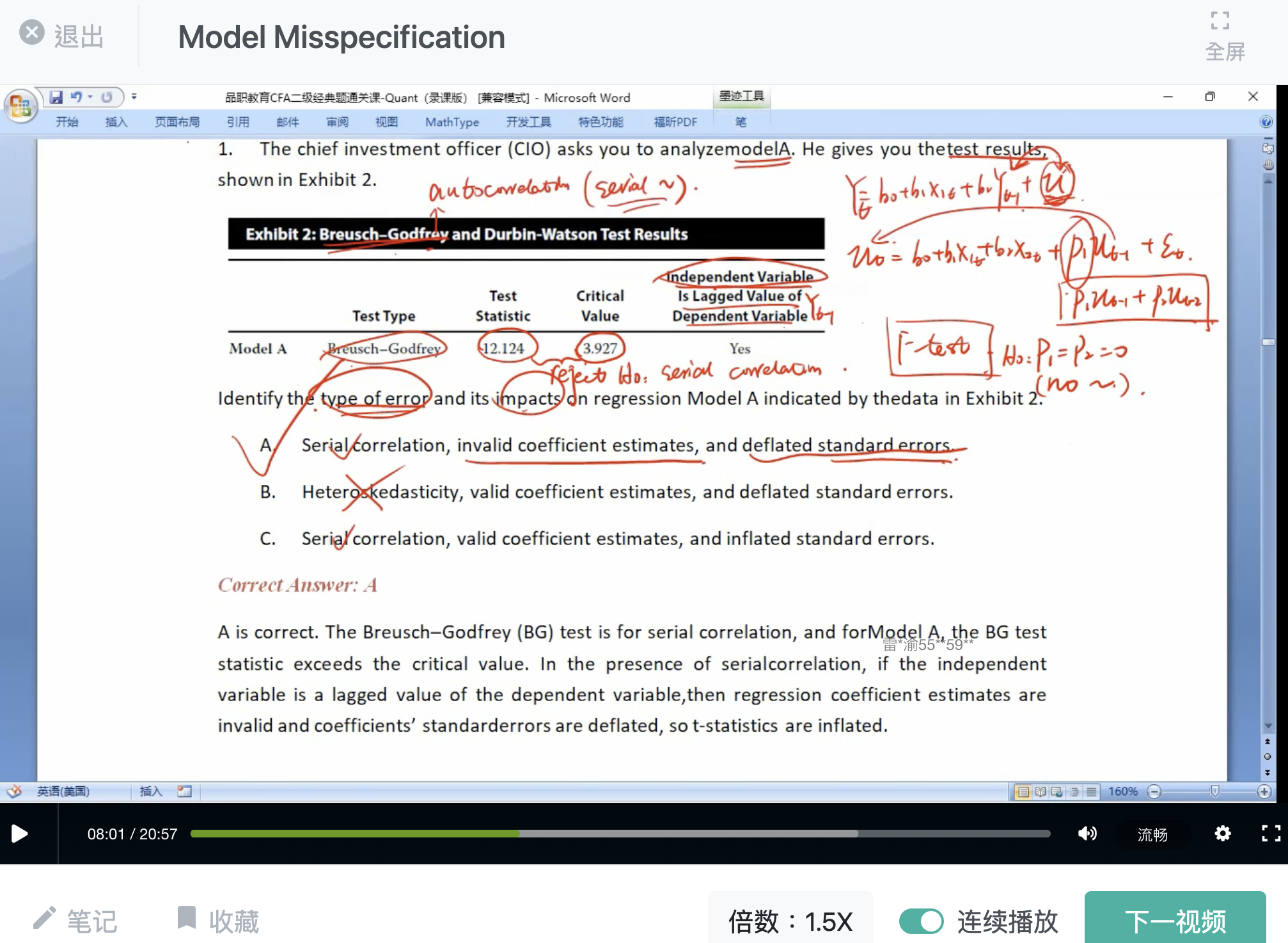

The chief investment officer (CIO) asks you to analyze

model A. He gives you the test results, shown in Exhibit 2.

Identify the type of error and its impacts on

regression Model A indicated by the data in Exhibit 2.

选项:

A.Serial correlation, invalid coefficient estimates, and

deflated standard errors

Heteroskedasticity, valid coefficient estimates, and

deflated standard errors

Serial correlation, valid coefficient estimates, and

inflated standard errors.

解释:

A is correct. The Breusch–Godfrey (BG) test is for

serial correlation, and for Model A, the BG test statistic exceeds the critical

value. In the presence of serial correlation, if the independent variable is a

lagged value of the dependent variable, then regression coefficient estimates

are invalid and coefficients’ standard errors are deflated, so t-statistics are

inflated.

助教你好,这题我答对了,也听了何老师的讲解。

何老师说如果exhibit 2中最后一栏(independent variable is lagged value of dependent variable)写着No,那得出的结论是serial correlation和valid coefficient estimates;我想确认一下,standard error是deflated standard error吗?谢谢。