Help keep your personal data safe with Avast One

- Security

- Privacy

- Performance

If you’re making a purchase online or over the phone, chances are you’ll need your card verification value (CVV) to confirm the purchase. But what is a CVV number? Read on to learn all about CVV codes and where to find yours. Then, get a comprehensive online security tool like Avast One to help keep your passwords and personal data safe.

CVV stands for “card verification value,” which is a unique code printed on payment cards that’s used to authorize payments made online or over the phone. CVV numbers help protect you if your credit or debit card number is stolen. If someone gets hold of your card number, but not the CVV, it’s harder for them to make fraudulent transactions.

This Article Contains:

Scams — like phishing attacks or social engineering attacks — can sometimes lead to identity theft, which is exactly what the CVV on a debit card and credit card can help prevent.

Most card issuers use a three-digit code on credit and debit cards, including VISA, Mastercard, and Discover. But American Express uses a four-digit CVV. Each CVV is unique to the card and account holder, meaning there’s no universal CVV code.

CVV is the standard industry term, but card issuers use different acronyms. Here’s what the security code on a debit card or credit card is called by each issuer:

| Acronym |

Definition |

Card issuer |

| CVV2 |

Card Verification Value 2 |

Visa |

| CVC2 |

Card Verification Value 2 |

Mastercard |

| CID |

Card Identification Number |

American Express |

| CVV |

Card Verification Value |

Discover |

The only difference between a CVV and a CVV2 is how the number is generated. The ‘2’ signifies that a CVV2 was created using a second-generation algorithm, meaning the code is more secure and harder to guess. But functionally, a CVV and a CVV2 are the same.

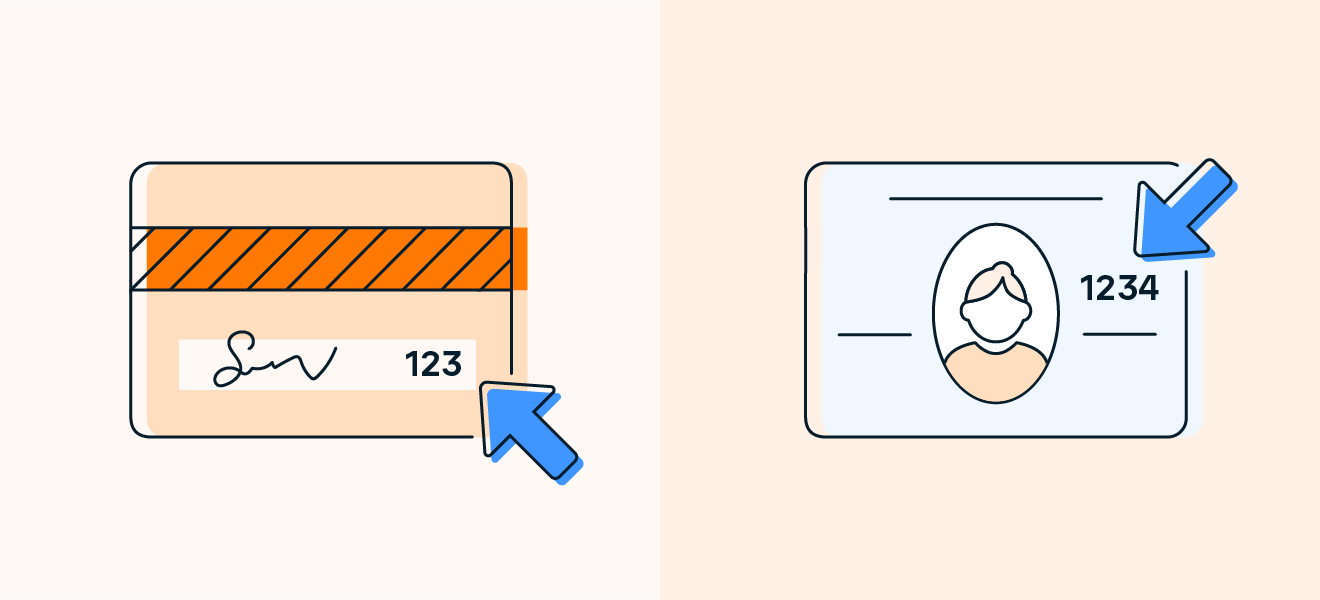

Visa, Mastercard, and Discover add the CVV number to the back of your card either as the last number on the signature strip or just to the right of it. American Express puts the security code on the front of the card above the account number — usually on the right.

The CVV number can be on the front or the back of a card.

The CVV number can be on the front or the back of a card.

What may seem like a random number is actually a security code generated using a complex algorithm. Each CVV is created specifically for the card, and it’s based on unique factors like the card number, expiration date, and particular codes from the card issuer. That means your CVV changes each time a replacement card is issued.

A dynamic CVV is a temporary card verification code that some banks use instead of the static CVV number on a card, meaning the CVV changes frequently. Dynamic CVVs work in a similar way to multi-factor or two-factor authentication (2FA), making them the next evolution of secure online payments. Usually, you access a dynamic CVV through your banking app.

A CVV and a PIN (Personal Identification Number) are two different numbers that serve distinct purposes. A CVV is used to verify payments online and over the phone, which provides a layer of protection against identity theft. A PIN is used in person to authorize account access at an ATM or during an in-store transaction.

CVV numbers are generated by the card issuer and printed onto the card, so you can’t change them. In contrast, a PIN is usually a four-digit code that you can (and should) change.

Your CVV number is safe to share with legitimate online retailers so they can confirm your identity and verify that you have the physical card in your possession. Although most e-commerce sites always ask for your CVV, some let you pay for your online shopping without a CVV code once you’ve made your first purchase.

Don’t share your CVV numbers with someone you don’t know or trust, or with a vendor you don’t remember purchasing from.

Never give out your CVV when using your credit or debit card in person. Anyone asking for your CVV during an in-person transaction could be trying to steal your information. It’s only safe to give your CVV number over the phone or on a secure site.

Never give out your CVV when paying in person.

Never give out your CVV when paying in person.

Here are some tips to help keep your CVV and credit card number safe:

Only enter your details on trusted websites. Check that you’re shopping on an https site, which means the website holds an SSL certificate and your data is encrypted.

Don’t save your card details to your browser or a retailer’s website. Although auto-fill is convenient, it’s better to enter your card details manually for every purchase. But if you have to, there are safe ways to manage your passwords in Google Chrome .

Don’t share your CVV in person. Don’t share your CVV with anyone unless you’re making a purchase online or over the phone.

Don’t share photos of your cards with family or friends. Photos of your card details often end up stored in places like iCloud or Google Photos, where they can more easily be part of a data breach or hacking attempt. If this happens to you, act quickly and remove personal information from online.

Use a VPN when not on your home network. Whenever you’re traveling or using public Wi-Fi, make sure you use a VPN. A VPN will help protect the personal information you send and receive online, keeping hackers away from your data.

Install antivirus software. Protect your devices with antivirus software. Aside from scanning for viruses, it also keeps your device free of keystroke logging software and other malicious tools hackers use to steal personal information.

Use a password manager to protect your accounts. A good password manager reduces the risk of being hacked, and it should secure any accounts where you’ve entered your card details previously.

Watch out for phishing scams. Beware of clicking suspicious links in emails and text messages — they may be infected with malware. And never provide card or financial details over email or text message.

Monitor your accounts for suspicious activity. Check your card statements regularly so you can spot fraudulent activity quickly. If there’s a charge you don’t recognize, contact your bank immediately.

Avast One helps you browse, shop, and bank securely online. It automatically blocks fake and dangerous websites that may be out to harvest your data. And if one of your passwords is compromised, you’ll get a notification so you can start reacting to the leak right away. Plus, Avast One offers real-time protection against a variety of today’s online threats. Install it for free today.

Download free Avast One to safeguard your personal data and find out if your sensitive information has been exposed in a data leak.

Install free Avast One to safeguard your personal data and find out if your sensitive information has been exposed in a data leak.

Install free Avast One to safeguard your personal data and find out if your sensitive information has been exposed in a data leak.

Download free Avast One to safeguard your personal data and find out if your sensitive information has been exposed in a data leak.

Help keep your personal data safe with Avast One

Help keep your personal data safe with Avast One