Businesses often turn to loans to manage everyday expenses like payroll and buying materials. A good credit history and profits make it easy to secure loans from banks, often at attractive rates. However, loans may not be the ideal solution for every financial situation.

In specific cases, such as fulfilling a substantial purchase order (PO), businesses might opt for Purchase Order (PO) financing over a traditional bank loan. This strategic choice helps address the unique needs of handling large orders. Unlike loans, PO financing provides quick funding to produce or purchase goods required to fulfill the order.

This short-term financial tool proves advantageous in situations where immediate capital is crucial. By understanding when to leverage PO financing, businesses can make strategic financial decisions that align with their operational requirements and promote efficient capital management.

What is Purchase Order Financing?

Purchase Order Financing (POF) is a short-term funding solution that helps businesses fulfill customer orders when they lack the necessary capital. In essence, it provides financial support for the production or purchase of goods before a company receives payment from its customers.

Also Read: A Complete Guide on Purchase Order Financing: What it is and How it works?

How does it Work?

Here’s how it typically works:

Customer Order: A business receives a large order from a customer but lacks the funds to fulfill it.

Purchase Order Financing Request:The business seeks assistance from a Purchase Order Financing company, providing details of the customer order and associated costs.

Financing Approval: The Purchase Order Financing company assesses the request, considering the creditworthiness of the customer and the viability of the transaction. If approved, they provide the necessary funds.

Goods Production: With the funds, the business can now produce or purchase the goods needed to fulfill the customer’s order.

Goods Delivery: The produced or purchased goods are delivered to the customer.

Customer Payment: Once the customer pays for the goods (usually within agreed-upon credit terms), the business repays the Purchase Order Financing company, often along with a fee.

Who Benefits Most from Purchase Orders?

Here’s a quick glance into who all benefit from PO financing.

Businesses Reliant on Invoicing: For businesses heavily dependent on invoicing, the Catch-22 arises. While purchase orders may enhance client relationships, the challenge lies in assessing working capital for job completion.

Working Capital Dilemma: In a scenario where income is tied up in unpaid invoices, accessing necessary supplies and labor becomes challenging. This poses a significant hurdle for small to medium-sized business owners.

PO Financing Solution: When facing a large order or experiencing a temporary slowdown, Purchase Order (PO) financing becomes a potential solution. It offers a way to navigate through such financial challenges.

Balancing Act: While purchase orders attract and retain customers, businesses must ensure they work in their favor. Unpaid invoices in Accounts Receivable can otherwise drag down the entire business.

To make an informed decision, businesses should weigh the advantages and disadvantages of PO financing. This guide provides insights into why and when PO financing can be a beneficial cash solution.

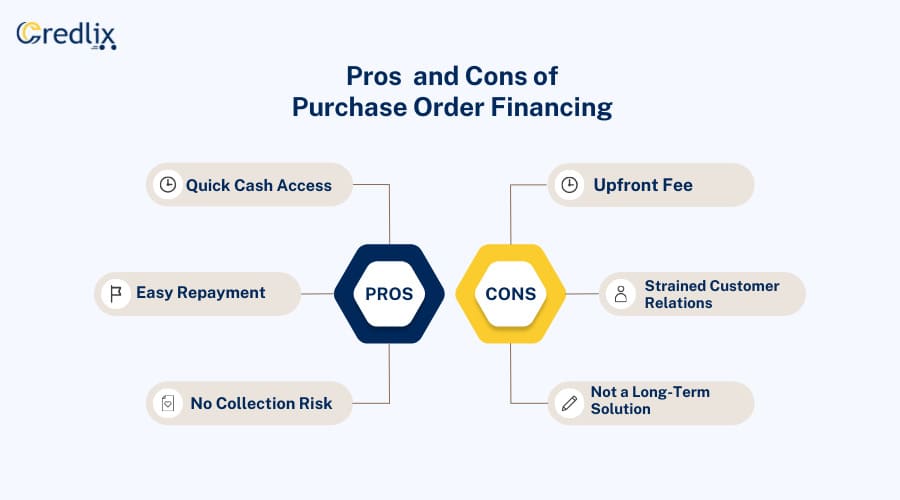

Pros and Cons of Purchase Order Financing

Here are some of the major pros and cons of PO financing that you should know beforehand in order to make a smart and informed decision.

Pros

Quick Cash Access

Gaining quick access to funds is a paramount advantage of purchase order financing. Unlike traditional banks, which involve prolonged processes, purchase order financing ensures swift access to funds, often within 24 hours.

This accelerated timeline is a game-changer for businesses facing urgent financial needs.

For instance, consider a small apparel company that secures a significant order from a major retailer but lacks the upfront capital to fulfill it. By leveraging purchase order financing through platforms like YubiFlow, the apparel company can access funds promptly, enabling them to meet the retailer’s order requirements seamlessly and capitalize on valuable business opportunities.

Easy Repayment

Repaying funds through purchase order financing is straightforward and cost-effective. Unlike loans with complex EMIs and interest charges, purchase order financing operates on a simple principle. Businesses repay the financing company once their customer settles the invoice.

Imagine a small electronics retailer fulfilling a large order but lacking the immediate funds. Through purchase order financing, they secure the needed capital. When the customer pays for the electronics, the retailer repays the financing company. This uncomplicated process not only saves the retailer from hefty interest fees but also aligns repayment with incoming revenue, ensuring financial ease and sustainability.

No Collection Risk

Purchase order financing eliminates the worry of payment collection for businesses. When a company secures funds through this method, the financing company takes on the responsibility of collecting payment from the customer. Imagine a small craft supplier with a large order from a new client.

With purchase order financing, they receive the funds upfront, and the financing company ensures the customer pays the invoice directly. This shields the craft supplier from the risk of non-payment, allowing them to focus on fulfilling orders and growing their business without the concerns of chasing payments or dealing with potential losses.

Cons

Upfront Fee

While purchase order financing doesn’t involve interest charges, it does come with an upfront fee that businesses must pay before receiving the funds. Think of it as a service fee to access quick cash. For instance, a small manufacturing company secures a large order but lacks the funds to fulfill it immediately.

Opting for purchase order financing, they pay a set upfront fee to the financing company, ensuring swift access to the needed funds. Businesses considering this financing option should factor in this upfront fee as part of the overall cost and carefully choose a financing company that aligns with their budget and needs.

Strained Customer Relations

Engaging a financing company might impact customer relations, potentially straining the business-customer dynamic. Imagine a small printing business securing funds through purchase order financing to meet a big order from a longstanding client. As the financing company directly interacts with the customer for invoice collection, the client may feel uneasy about this external involvement.

This situation highlights how involving a financing entity could potentially affect the established trust and rapport between businesses and their clients. Careful consideration is crucial, ensuring that the chosen financing approach aligns with maintaining positive and long standing customer relationships.

Not a Long-Term Solution

Purchase order financing serves as a short-term solution, offering immediate relief but lacking long-term benefits. Picture a small manufacturing business using purchase order financing to fulfill a sudden surge in orders.

While it effectively addresses the current demand, businesses must recognize that it doesn’t resolve underlying issues or contribute to sustainable growth. Relying solely on this short-term fix may even impact future orders.

To illustrate, if the manufacturing process isn’t optimized or if the root cause of financial strain persists, businesses may face challenges fulfilling subsequent orders. It’s crucial for businesses to carefully assess the short-term nature of purchase order financing and explore holistic, long-term solutions for sustained success.

Understanding Purchase Order Financing Costs

Understand the cost aspect of purchase order financing:

Agreed Funding Percentage: When utilizing Purchase Order (PO) financing, the financier commits to funding a certain percentage of supplier costs. You are responsible for covering the remaining portion.

Example: For instance, if the lender agrees to finance 50% of the PO and charges 3% interest per 30 days, the financing cost is calculated. For a $1,000,000 PO over 60 days, the interest amounts to $60,000.

Cash Advance: After deducting fees, you receive a cash advance, in this case, $440,000. The lender directly pays the supplier for materials, which are then shipped to you.

Interest on Advance:In scenarios involving down payments, interest is charged on the advance amount and the remainder separately.

Financial Support for PO Settlement: Purchase order financing provides the financial backing needed to fulfill the purchase order, ensuring a smooth transaction.

Pre-Agreed Fees: All fees and costs associated with PO financing are pre-agreed during the lending agreement, eliminating any unexpected surprises.

Optimizing Operations with Credlix

Credlix streamlines the purchase order financing journey, offering competitive rates and eliminating delays. Experience a hassle-free process, ensuring quick and trouble-free loans for approved purchase orders.

Credlix’s PO Financing provides seamless access to vital working capital, empowering your company to effortlessly fulfill confirmed purchase orders with unparalleled efficiency.

Also Read: The Entrepreneur`s Guide to Purchase Order Financing for Startups

Final Words

Purchase Order (PO) financing offers a quick and straightforward way for businesses to meet immediate capital needs, especially when handling large orders. With its rapid access to funds and uncomplicated repayment tied to invoice settlements, PO financing proves beneficial. However, businesses should carefully weigh considerations like upfront fees and short-term nature.

While it’s a reliable solution for urgent financial needs, exploring long-term strategies for sustained growth is essential. Balancing the advantages of quick cash access, easy repayment, and risk mitigation empowers businesses to make informed decisions for financial stability and operational efficiency.