BizFile eGuide on filing of annual return - ACRA

BizFile eGuide on filing of annual return - ACRA

BizFile eGuide on filing of annual return - ACRA

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Guide To Filing <strong>of</strong> Annual Return for Local Companies<br />

Limited By Shares (with effect from 1 November 2007)<br />

The company must file its Annual Return within 30 days from the date <strong>of</strong> the<br />

Annual General Meeting. With effect from 1 November 2007, the Summary<br />

<strong>of</strong> Return (SR) will be merged with the Main Return (MR) to form <strong>on</strong>e<br />

document i.e. the Annual Return (AR).<br />

FILING THE ANNUAL RETURN<br />

If you are required to file the financial statements in XBRL format, please ensure that<br />

you have uploaded your XBRL financial statements to <str<strong>on</strong>g>BizFile</str<strong>on</strong>g> at least 1 week prior to<br />

the AR <strong>filing</strong>. If you have not prepared your XBRL financial statements, please click<br />

<strong>on</strong> Preparati<strong>on</strong> <strong>of</strong> Financial Statements in XBRL at <str<strong>on</strong>g>BizFile</str<strong>on</strong>g> homepage to prepare first.<br />

The particulars in the AR must be verified for accuracy with the relevant company<br />

<strong>of</strong>ficer at least 14 days before <strong>filing</strong> the AR.<br />

<br />

<br />

<br />

<br />

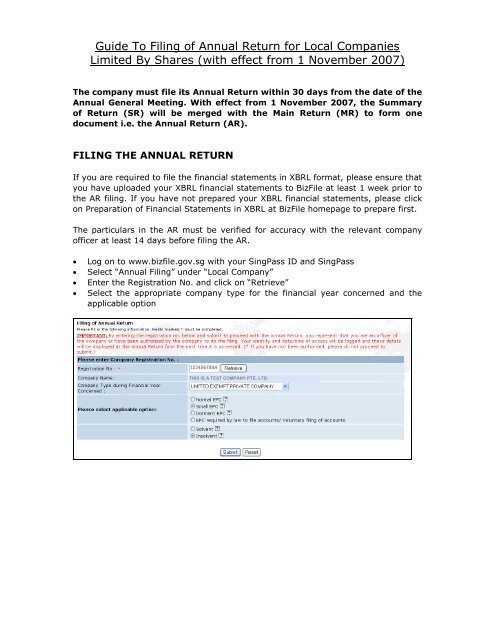

Log <strong>on</strong> to www.bizfile.gov.sg with your SingPass ID and SingPass<br />

Select “Annual Filing” under “Local Company”<br />

Enter the Registrati<strong>on</strong> No. and click <strong>on</strong> “Retrieve”<br />

Select the appropriate company type for the financial year c<strong>on</strong>cerned and the<br />

applicable opti<strong>on</strong><br />

123456789A<br />

THIS IS A TEST COMPANY PTE. LTD.

View the Office, Officers and Charges Details to check the accuracy <strong>of</strong> informati<strong>on</strong><br />

THIS IS A TEST COMPANY PTE. LTD.<br />

123456789A<br />

<br />

<br />

Click “Next”<br />

View the Share Capital Details and update the other informati<strong>on</strong> <strong>on</strong> shares, where<br />

applicable<br />

THIS IS A TEST COMPANY PTE. LTD.<br />

123456789A<br />

<br />

<br />

Click “Next”<br />

Enter the date <strong>of</strong> Annual General Meeting (or the date <strong>of</strong> resoluti<strong>on</strong> to dispense<br />

with the AGM) at the AGM and Financial Details page<br />

THIS IS A TEST COMPANY PTE. LTD.<br />

123456789A

For financial period ending before 30 April 2007<br />

Scan and attach the full set <strong>of</strong> financial statements as a pdf file under “For<br />

Financial Statements in PDF” (if applicable)<br />

Click <strong>on</strong> the directors who signed the Director’s Report and Statement<br />

Answer “Yes” or “No” to whether the company has any share-based payment<br />

plans<br />

Answer “Yes” or “No” to whether the company has underg<strong>on</strong>e any mergers or<br />

acquisiti<strong>on</strong>s<br />

Answer “Yes” or “No” to whether the company is exempted from audit<br />

‣ If the company is not exempted from audit:<br />

o Questi<strong>on</strong>s pertaining to the name <strong>of</strong> the public accounting entity, the<br />

name <strong>of</strong> the auditor and whether the auditors’ report is modified, are<br />

mandatory<br />

<br />

<br />

<br />

<br />

If the company is <strong>filing</strong> its financial statements, please complete the “Financial<br />

Highlights” secti<strong>on</strong><br />

Click “Next”<br />

Select the applicable opti<strong>on</strong>s in the Declarati<strong>on</strong> page<br />

Click “Submit”<br />

For financial period ending <strong>on</strong> or after 30 April 2007<br />

<br />

Select <strong>on</strong>e <strong>of</strong> the <strong>filing</strong> opti<strong>on</strong>s:<br />

‣ Opti<strong>on</strong> A – Full XBRL (A company which chooses to file its full set <strong>of</strong> financial<br />

statements in XBRL format for its AR will have to use FS Manager to prepare<br />

its full set <strong>of</strong> financial statements for AGM purposes)<br />

‣ Opti<strong>on</strong> B – Partial XBRL (A company which chooses to file <strong>on</strong>ly its Balance<br />

Sheet and Income Statement in XBRL format must also file a PDF copy <strong>of</strong> its<br />

full set <strong>of</strong> financial statements as used for AGM purposes)<br />

‣ Opti<strong>on</strong> C – Full PDF format (Applicable for excluded categories such as<br />

banks, insurance companies regulated by MAS which are not required to file<br />

their financial statements in XBRL format)

If Opti<strong>on</strong> A is selected:<br />

‣ If the XBRL financial statements have been uploaded to <str<strong>on</strong>g>BizFile</str<strong>on</strong>g> previously, it<br />

will be shown at the AGM and Financial Details page. Click <strong>on</strong> the radio butt<strong>on</strong><br />

under the “Select” column to choose which financial statements to file with<br />

the AR.<br />

‣ Else if you have not uploaded your XBRL financial statements, you may click<br />

<strong>on</strong> the “Go To FS Manager” butt<strong>on</strong> to load the financial statements from your<br />

local drive or any other storage device.<br />

If Opti<strong>on</strong> B is selected:<br />

‣ If the partial XBRL financial informati<strong>on</strong> has been uploaded to <str<strong>on</strong>g>BizFile</str<strong>on</strong>g><br />

previously, it will be shown at the AGM and Financial Details page. Click <strong>on</strong><br />

the radio butt<strong>on</strong> under the “Select” column to choose which <strong>on</strong>e to file with<br />

the AR.<br />

‣ Else if you have not uploaded your partial XBRL financial informati<strong>on</strong>, you<br />

may click <strong>on</strong> the “Go To FS Manager” butt<strong>on</strong> to load the financial informati<strong>on</strong><br />

from your local drive or any other storage device.<br />

‣ Scan and attach the full set <strong>of</strong> financial statements as a PDF file under “For<br />

Financial Statements in PDF”.<br />

If Opti<strong>on</strong> C is selected:<br />

‣ Attach the PDF copy <strong>of</strong> the full financial statements and complete the<br />

mandatory fields<br />

<br />

<br />

<br />

Click “Next”<br />

Select the applicable opti<strong>on</strong>s in the Declarati<strong>on</strong> page<br />

Click “Submit”

PREVIEW PAGE<br />

<br />

<br />

<br />

Preview the informati<strong>on</strong> in the AR to ensure the accuracy <strong>of</strong> details before<br />

submissi<strong>on</strong><br />

Click <strong>on</strong> “Print This Page” to print out a copy <strong>of</strong> the preview page for your<br />

reference<br />

Click “Submit” to make payment for the transacti<strong>on</strong><br />

FEES<br />

Online Transacti<strong>on</strong> Fee Payable<br />

Filing <strong>of</strong> Annual Return $20<br />

Payment Modes<br />

• E-Nets Debit (Internet Banking)<br />

• CashCard<br />

• Credit Card (Visa/Mastercard/AMEX)<br />

FREQUENTLY ASKED QUESTIONS<br />

1. What is the definiti<strong>on</strong> <strong>of</strong> solvent?<br />

Solvent means that the company is able to pay its debts when it falls due.<br />

2. My company is a solvent exempt private company (EPC), do I need to file<br />

financial statements in XBRL?<br />

Solvent EPCs are not required to file financial statements with <strong>ACRA</strong>. However if you<br />

choose to file your financial statements with <strong>ACRA</strong>, please select under “Voluntary<br />

Filing <strong>of</strong> Accounts” and file your financial statements in XBRL.<br />

3. My company is dormant, do I need to file financial statements in XBRL?<br />

Yes, dormant companies need to file financial statements in XBRL. However financial<br />

statements can be unaudited.<br />

Address : No 10, Ans<strong>on</strong> Road, #05-01/15,<br />

Internati<strong>on</strong>al Plaza. Singapore 079903<br />

<strong>ACRA</strong> Helpdesk : (65) 6248 6028<br />

Fax : (65) 6225 1676<br />

<strong>ACRA</strong> Homepage : www.acra.gov.sg<br />

<str<strong>on</strong>g>BizFile</str<strong>on</strong>g> Website : www.bizfile.gov.sg<br />

ASK <strong>ACRA</strong> Website : www.acra.gov.sg/askacra