This Issue - Icwai

This Issue - Icwai

This Issue - Icwai

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

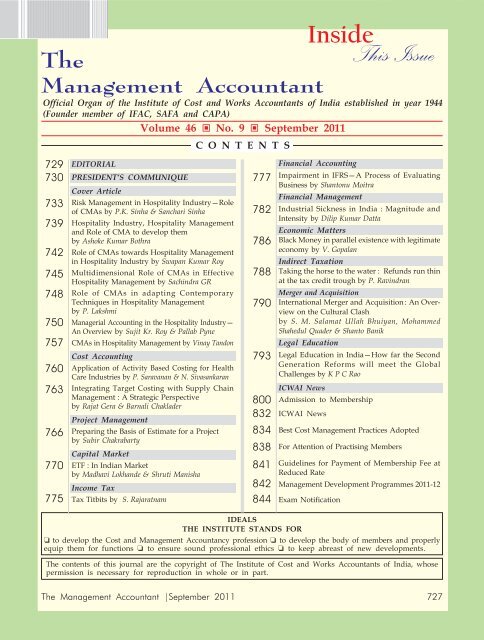

The<br />

Management Accountant<br />

Official Organ of the Institute of Cost and Works Accountants of India established in year 1944<br />

(Founder member of IFAC, SAFA and CAPA)<br />

Volume 46 � No. 9 � September 2011<br />

729<br />

730<br />

733<br />

739<br />

742<br />

745<br />

748<br />

750<br />

757<br />

760<br />

763<br />

766<br />

770<br />

775<br />

EDITORIAL<br />

PRESIDENT’S COMMUNIQUE<br />

Cover Article<br />

Risk Management in Hospitality Industry—Role<br />

of CMAs by P.K. Sinha & Sanchari Sinha<br />

Hospitality Industry, Hospitality Management<br />

and Role of CMA to develop them<br />

by Ashoke Kumar Bothra<br />

Role of CMAs towards Hospitality Management<br />

in Hospitality Industry by Swapan Kumar Roy<br />

Multidimensional Role of CMAs in Effective<br />

Hospitality Management by Sachindra GR<br />

Role of CMAs in adapting Contemporary<br />

Techniques in Hospitality Management<br />

by P. Lakshmi<br />

Managerial Accounting in the Hospitality Industry—<br />

An Overview by Sujit Kr. Roy & Pallab Pyne<br />

CMAs in Hospitality Management by Vinay Tandon<br />

Cost Accounting<br />

Application of Activity Based Costing for Health<br />

Care Industries by P. Saravanan & N. Sivasankaran<br />

Integrating Target Costing with Supply Chain<br />

Management : A Strategic Perspective<br />

by Rajat Gera & Barnali Chaklader<br />

Project Management<br />

Preparing the Basis of Estimate for a Project<br />

by Subir Chakrabarty<br />

Capital Market<br />

ETF : In Indian Market<br />

by Madhavi Lokhande & Shruti Manisha<br />

Income Tax<br />

Tax Titbits by S. Rajaratnam<br />

C O N T E N T S<br />

Inside<br />

<strong>This</strong> <strong>Issue</strong><br />

IDEALS<br />

THE INSTITUTE STANDS FOR<br />

❏ to develop the Cost and Management Accountancy profession ❏ to develop the body of members and properly<br />

equip them for functions ❏ to ensure sound professional ethics ❏ to keep abreast of new developments.<br />

The contents of this journal are the copyright of The Institute of Cost and Works Accountants of India, whose<br />

permission is necessary for reproduction in whole or in part.<br />

The Management Accountant |September 2011 727<br />

777<br />

782<br />

786<br />

788<br />

790<br />

793<br />

800<br />

832<br />

834<br />

838<br />

841<br />

842<br />

844<br />

Financial Accounting<br />

Impairment in IFRS—A Process of Evaluating<br />

Business by Shantonu Moitra<br />

Financial Management<br />

Industrial Sickness in India : Magnitude and<br />

Intensity by Dilip Kumar Datta<br />

Economic Matters<br />

Black Money in parallel existence with legitimate<br />

economy by V. Gopalan<br />

Indirect Taxation<br />

Taking the horse to the water : Refunds run thin<br />

at the tax credit trough by P. Ravindran<br />

Merger and Acquisition<br />

International Merger and Acquisition : An Overview<br />

on the Cultural Clash<br />

by S. M. Salamat Ullah Bhuiyan, Mohammed<br />

Shahedul Quader & Shanto Banik<br />

Legal Education<br />

Legal Education in India—How far the Second<br />

Generation Reforms will meet the Global<br />

Challenges by K P C Rao<br />

ICWAI News<br />

Admission to Membership<br />

ICWAI News<br />

Best Cost Management Practices Adopted<br />

For Attention of Practising Members<br />

Guidelines for Payment of Membership Fee at<br />

Reduced Rate<br />

Management Development Programmes 2011-12<br />

Exam Notification

ICWAI ICWAI UPDATES<br />

UPDATES<br />

PRESIDENT<br />

M. Gopalakrishnan<br />

email : president@icwai.org<br />

VICE PRESIDENT<br />

Rakesh Singh<br />

email : vicepresident@icwai.org<br />

COUNCIL MEMBERS<br />

Amit Anand Apte, A. Om Prakash,<br />

Aruna Vilas Soman, A.S. Durga Prasad,<br />

Dr. Sanjiban Bandyopadhyaya, Hari Krishan Goel,<br />

Manas Kumar Thakur, P.V.S. Jagan Mohan Rao,<br />

Pramodkumar Vithaldasji Bhattad, Sanjay Gupta,<br />

S.R. Bhargave, Suresh Chandra Mohanty,<br />

T.C.A. Srinivasa Prasad<br />

Senior Director (Examinations)<br />

Chandana Bose<br />

exam.cb@icwai.org<br />

Senior Director<br />

(Administration & Finance)<br />

R N Pal<br />

fna.rnpal@icwai.org<br />

Director (Technical)<br />

J. P. Singh<br />

technical.jps@icwai.org<br />

Director (Studies)<br />

Arnab Chakraborty<br />

studies.arnab@icwai.org<br />

Director (CAT), (Training & Placement)<br />

L. Gurumurthy<br />

cat.gurumurthy@icwai.org<br />

Director (PD)<br />

J. K. Budhiraja<br />

pd.budhiraja@icwai.org<br />

Director (CEP)<br />

D. Chandru<br />

cep.chandru@icwai.org<br />

Director (Discipline, Membership & Legal) & Joint Secretary<br />

Kaushik Banerjee<br />

membership.kb@icwai.org<br />

Director (Advanced Studies)<br />

Dr. Alok Pandey<br />

advstudies.alok@icwai.org<br />

Director (F & A)<br />

S. R. Saha<br />

fna.saha@icwai.org<br />

Sr. Additional Director (Admin)<br />

S. C. Gupta<br />

admin.gupta@icwai.org<br />

EDITOR<br />

Rajendra Bose<br />

Editorial Office & Headquarters<br />

12, Sudder Street, Kolkata-700 016<br />

Phone : (033) 2252-1031/34/35,<br />

Fax : (033) 2252-1602/1492<br />

Website : www.icwai.org<br />

Delhi Office<br />

ICWAI Bhawan<br />

3, Institutional Area, Lodi Road<br />

New Delhi-110003<br />

Phone : (011) 24622156, 24618645,<br />

Fax : (011) 24622156, 24631532, 24618645<br />

MISSION STATEMENT<br />

“ICWAI Professionals would ethically<br />

drive enterprises globally by creating value to<br />

stakeholders in the socio-economic context through<br />

competencies drawn from the integration of<br />

strategy, management and accounting.”<br />

VISION STATEMENT<br />

“ICWAI would be the preferred source of resources<br />

and professionals for the financial<br />

leadership of enterprises globally.’’<br />

DISCLAIMER<br />

The views expressed by the authors are personal<br />

and do not necessarily represent the views<br />

and should not attributed to ICWAI.<br />

The Management Accountant Technical Data<br />

Periodicity Monthly<br />

Language English<br />

Overall size — 26.5 cm. x 19.5 cm.<br />

Printed Area — 24 cm. x 17 cm.<br />

Screens — up to 130<br />

Subscription<br />

Rs. 300/- (Inland) p.a.<br />

Single Copy: Rs. 30/-<br />

Overseas<br />

US $150 for Airmail<br />

US $ 100 for Surface Mail<br />

Concessional Subscription Rates for Registered<br />

Students & Grad CWAs of the Institute<br />

Rs. 150/- p.a.<br />

Single Copy: Rs. 15/- (for ICWAI Students & Grad CWAs)<br />

Revised Rates for Advertisement<br />

The Management Accountant<br />

Rs. (US $)<br />

Back Cover (colour only) 50,000 2,500<br />

Inside Cover (colour only) 35,000 2,000<br />

Ordy. Full page (B/W only) 20,000 1,500<br />

Ordy. Half page (B/W only) 12,000 1,250<br />

Ordy. Qrtr. page (B/W only) 7,500 750<br />

The Institute reserves the right to refuse any matter<br />

of advertisement detrimental to the interest of the Institute.<br />

The decision of the Editor in this regard will be final.<br />

728 The Management Accountant |September 2011

Indian travel<br />

and tourism sector<br />

is the third<br />

largest foreign<br />

exchange<br />

earner<br />

EDITORIAL<br />

EDITORIAL<br />

People, since time immemorial, have always looked for opportunities to get out of their monotonous and mundane<br />

life for seeking leisure. In earlier days, when life was not very complex and relatively hassle free, people had<br />

some free time at their disposal to indulge in leisurely pursuits – be it dining outside or travelling to see places<br />

of interest. Today, with life style becoming increasingly complex, need is felt all the more to take a break from<br />

hectic schedule and fly to some exotic destination or go on a cruise on a pleasure voyage where the cruise/<br />

voyage itself and the amenities in the ship are a part of fabulous holidaying. <strong>This</strong> is what is called as ‘Hospitality’<br />

which, according to Oxford dictionary means “the reception and entertainment of guests, visitors or strangers<br />

with liberality and goodwill”. One must remember that hospitality is not merely confined to eating outside<br />

(restaurants/eating joints) or travelling (railway/airline/ship) or lodging (hotel) but it encompasses all such<br />

activities/fields as theme parks, clubs, resorts, casinos, all recreational markets, stadiums, amphitheatres etc.<br />

‘Hospitality’ is the corner stone of such activities which, in the western world, is associated with etiquette and<br />

entertainment.<br />

The hospitality industry is one of the most exciting and challenging industry with enormous growth potential.<br />

It is a multi billion industry worldwide and India is not lagging far too behind if foreign exchange earnings are<br />

an indicator as Indian travel and tourism sector is the third largest foreign exchange earner accounting for<br />

almost 6% of the GDP. It also makes a direct contribution to economy with significant linkages to agriculture,<br />

horticulture, handicrafts and construction. The hospitality industry went into a tail spin during 2007-08; thanks<br />

to the sub- prime crisis in US which left a scar on the economy of some of the most powerful nations though it<br />

had not impacted India to a major extent. The Indian tourism industry is now witnessing exponential growth<br />

and it has outperformed the global tourism industry in terms of growth in the volume of international tourists<br />

as well as in terms of revenue. The key driver for this growth in Indian tourism industry has been a fast<br />

growing economy for the last 2-3 years. Despite lagging in the basic infrastructure that supports the tourism<br />

industry; Indian tourism sector has been showing an impressive double digit growth. The government, of late,<br />

having fully realized the potential that this sector offers, has been investing in infrastructure such as transport<br />

and accommodation with a view to sustaining this growth.<br />

The hotel industry alone comprises a major chunk of the tourism industry. Historically viewed as an industry<br />

providing a luxury service valuable to the economy only as a foreign exchange earner, the industry today<br />

contributes directly to employment and indirectly facilitates tourism and commerce. Prior to the 1980’s, the<br />

Indian hotel industry was a slow growing industry displaying very sluggish growth rate consisting primarily of<br />

relatively static single hotel companies. However, the Asiad held in New Delhi in 1982, the world cup cricket<br />

(Reliance cup) held in India in 1987 and the subsequent partial liberalization of the Indian economy generated<br />

tourism interest in India with significant benefits accruing to the hotel and tourism sector in terms of improved<br />

demand patterns. With liberalization of the Indian economy in the early nineties, more foreign tourists started<br />

visiting India and this euphoria of the nineties continued unabated in the last decade which prompted new<br />

entrants and international chains to chalk out ambitious capacity additions, especially in the metropolitan cities.<br />

The government has allowed FDI up to 100% under the automatic route in townships, housing, built-up<br />

infrastructure and construction-development projects (which would include, but not be restricted to, housing,<br />

commercial premises, hotels, resorts, hospitals, educational institutions, recreational facilities, city and regional<br />

level infrastructure). However, most of these efforts were directed towards the business travellers and the<br />

foreign clientele. The urban Indian today, with high disposable income and frequent travel abroad for business<br />

or pleasure has been the order of the day. With the advent of IT/ITES/BPO/KPO’s, the traffic to India has<br />

increased by leaps and bounds which has given further impetus to the growth of tourism industry.<br />

CMA’s by virtue of their analytical skills and strong conceptual knowledge on subjects like Management<br />

Accounting, Operations Research etc can play a significant role in this sector not merely by application of<br />

traditional techniques of Cost Accounting like Zero Base Budgeting, Activity Based Costing, Cost Volume Profit<br />

analysis, Standard Costing, Inventory Management, Just In Time etc but also by application of OR techniques<br />

like Linear Programming, Queuing Theory, Simulation etc. They are the ones who evaluate operational efficiency<br />

and effectiveness of service management, identify accountability for variance analysis and help in strategic decision<br />

making. Typically, the CMA’s decision making in the hospitality sector can be:<br />

● The hotel swimming pool currently closes at 10.00 P.M. Would we sell more if the bar near the swimming pool<br />

remains open 24x7 ? They will also have to employ additional manpower to take care of the guests during the<br />

night time.<br />

● Would it be prudent to acquire land very near to the sea for building a resort or to take a bigger land at a place<br />

little away from the sea shore.<br />

● Will it pay to introduce an additional flight with no Business class to a certain destination or to reserve 20% of<br />

the seats for Business class and operate one single flight in a day?<br />

The above are some of the key issues which would require the expert opinion of CMA’s who can establish<br />

guidelines and benchmarks for long term profitability and viability of the organization. The present issue contains<br />

a number of interesting articles on this subject which I am sure, the readers will find useful and enriching.<br />

Editorial<br />

Editorial<br />

Editorial<br />

Editorial<br />

Editorial<br />

The Management Accountant |September 2011 729

M. Gopalakrishnan, President<br />

PRESIDENT’S PRESIDENT’S COMMUNIQUÉ<br />

COMMUNIQUÉ<br />

We must become the change we want to see.<br />

—Mahatma Gandhi<br />

Dear Professional Colleagues,<br />

Progress of any nation depends on the way the country’s governance aligns with the<br />

social and economic environment, with the capability to support each other. The<br />

systems established by good practices of the past, reinforced by legislative support<br />

enables the three to function complementing each other. Deviations from the set norms<br />

are capable of affecting the nation’s fabric including the common public in a myriad<br />

ways. Professionals like us, help the Government to flag any deviation from the norms<br />

and extend help in retuning the system in areas where we have domain specialization.<br />

Making the country’s governance system robust is an issue, which has been a key<br />

area of concern for the Government in the recent past. <strong>This</strong> issue has been addressed<br />

in many areas like Corporate Law administration, through the introduction of egovernance.<br />

It is necessary for extending it to all the key areas, affecting the trade,<br />

commerce and public, so that the physical interface, frequent follow up visits, deliberate<br />

delays, file pile and unnecessary litigation are avoided. As a profession professing<br />

managing costs, we have been strongly advocating e-governance as a major means<br />

by which the Governments can showcase their strong will on this matter to the public.<br />

Shri Amit Mitra, the Finance Minister of West Bengal, has made a silent revolution in<br />

his landmark State Finance Bill, 2011, presented to the State Legislature of West Bengal,<br />

through various bold administrative measures, by going the IT way and avoiding the<br />

avenues for delays and the resulting consequences. It is a showcase model which can<br />

be emulated by various authorities, who have not yet started adopting it.<br />

We need to look at other areas requiring improvement also. On this aspect, we must<br />

focus on basic necessities like water, sanitation, power, education and health. In<br />

addition, the recent reports point out that economy may not grow at the expected<br />

rates of more than 8.5% p.a. <strong>This</strong> requires tightening of belt and judicious application<br />

of scarce national resources. On this aspect, I am sure the members of ICWAI will<br />

provide the leadership to control the monster of inflation and other issues plaguing<br />

the purportedly slowing national economy, with their focused approach towards<br />

resource consumption.<br />

We know that ICWAI community has always been on the forefront in providing their<br />

services to the nation with sincerity and dedication. I urge my professional colleagues<br />

to reinforce the confidence reposed in them by public and corporates at large about<br />

the reliability of their work and skills<br />

As a knowledge management institution, I complement all our faculties on the occasion<br />

of Teacher’s Day, for the dedication with which they have been serving the profession,<br />

in shaping the future cost and management accountants. The major increase in the<br />

intake to the course, showcases the value added role they play in building the future<br />

of the profession.<br />

Events and meetings during the month<br />

In the month of August, 2011 myself and Vice President concentrated on meeting<br />

various dignitaries who play a key role in domestic and international arena, in shaping<br />

not only the country’s economy but also laying down a new path for nations to follow.<br />

We met Shri. V. Krishnamurthy, Chairman, National Manufacturing Competitiveness<br />

Council (NMCC) and Dr. M Govind Rao, Member, Economic Advisory Council to<br />

Prime Minister and Director, NIPFP respectively at New Delhi on 3rd August, 2011 to<br />

discuss the various key issues relating to the profession. We also met Dr C. Rangarajan,<br />

Chairman Economic Advisory Council of the Prime Minister and appraised him of<br />

the services rendered by the Institute . We appraised him of the various professional<br />

activities of the Institute. He evinced keen interest on the Management Accounting<br />

Guidelines published by the Institute.<br />

730 The Management Accountant |September 2011

PRESIDENT’S PRESIDENT’S COMMUNIQUÉ<br />

COMMUNIQUÉ<br />

Ms. Jessica Fries, Director, The Prince’s Accounting for<br />

Sustainability Project, London and Secretary, International<br />

Integrated Reporting Committee (IIRC) visited New Delhi.<br />

ICWAI team consisting of Mr. Rakesh Singh, Vice President;<br />

Mr. Sanjay Gupta, Chairman, WTO and International<br />

Committee; Mr. A N Raman, President, SAFA; Mr. Sudhir<br />

Sharma, Joint Director (Technical) and myself discussed<br />

the various issues concerning our position with respect to<br />

Integrated Reporting on 9th August, 2011. Next day Ms. Fries<br />

met senior officers in Ministry of Corporate Affairs (MCA)<br />

alongwith the ICWAI delegation led by me.<br />

Name Change of the institute is receiving the utmost<br />

attention of the Council of ICWAI. To continue the strategy<br />

for the future, the members of the Council held a special<br />

Meeting on 12th August, 2011 at New Delhi participated by<br />

some of the past presidents of the Institute also. The meeting<br />

passed an unanimous resolution to intensify the work for<br />

the change of name from ICWAI to to ICMAI. A delegation<br />

of Council members of the Institute met Dr. M. Veerappa<br />

Moily, Hon’ble Union Minister of Corporate Affairs and<br />

apprised him of the sentiments of lakhs of students and<br />

members of the ICWAI on the issue.<br />

I am pleased to inform ICWAI has submitted its Action<br />

Plan to IFAC and become the first CMA institute in the<br />

SAFA member bodies in the region to do so. The response<br />

of ICWAI is hosted on the website of the IFAC. The IFAC<br />

also commended the dedication and efforts with which the<br />

Institute has come out with the final document<br />

Myself along with the Vice President visited Ahmedabad<br />

for inaugurating the new Chapter building built with state<br />

of the art modern facilities for class rooms, conference room<br />

etc. I commend the chapter for creating such an excellent<br />

facility, which will be a role model for other chapters to<br />

follow. The chapter also organized a seminar on the new<br />

cost audit record rules and notifications.<br />

I had the proud privilege of hoisting the National Flag at<br />

our Institute Headquarters at Kolkata on the Independence<br />

Day. It was followed by an interactive meeting at EIRC.<br />

Smaller chapters are doing excellent work in strengthening<br />

the infrastructure of the Institute. I was happy to participate<br />

in the ceremony for laying the Foundation Stone of Thrissur<br />

Chapter on 17th August, 2011.<br />

Hyderabad Chapter organized a Seminar on New Cost<br />

Accounting Records and notifications which was attended<br />

by large number of delegates from the Industry and practice.<br />

The chapter also organized a meet with the CFO’s from<br />

large corporates which was well attended. It gave an<br />

opportunity to interact on professional issues and also to<br />

express our views on the benefits of the new rules vis-a-vis<br />

the old . We are planning to have many more such meets at<br />

different places and network with the top brass of the<br />

corporates which will provide us an opportunity to<br />

understand the challenges being faced by them and proper<br />

guidance where required from the Institute.<br />

On 23rd August, 2011 myself and Vice President, ICWAI<br />

shared ICWAI views on the status of progress on Investor<br />

Awareness Programmes in a joint meeting at Ministry of<br />

Corporate Affairs presided over by Secretary, MCA with<br />

other Partner Institutes. I request my fellow members and<br />

officials at Regional Councils, Chapters and ROCCs of<br />

ICWAI to organize maximum programmes at small centers<br />

throughout the country. <strong>This</strong> is also an opportunity to let<br />

the public know of the work by ICWAI for a common social<br />

cause.<br />

Launching of Co-branded Credit card by PNB & ICWAI<br />

I am happy to share with you that our Institute has entered<br />

into a MOU with Punjab National Bank (PNB) during May<br />

2011 in the matter of introducing a co-branded credit card<br />

for members of the Institute. <strong>This</strong> Co-Branded Credit Card<br />

was launched at a colourful function organized by PNB<br />

on 24th August 2011 at Bengal Club, Kolkata which<br />

was presided over by Shri K.R. Kamath, CMD PNB<br />

and Shri Satish Kaushik, Circle Head, PNB. I was joined<br />

by my colleagues in the Central Council Dr. Sanjiban<br />

Bandyopadhyaya, Shri T.C.A. Srinivasa Prasad and Shri<br />

Manas Kumar Thakur for the event. Shri R.N. Pal, Sr.<br />

Director (F & A) and other senior officials of the Institute<br />

were also present at this function.<br />

Cost Accounting Standards Board<br />

The Cost Accounting Standards Board Secretariat has<br />

prepared a revised Guidance Note on Cost Accounting<br />

Standard -4 (CAS-4). <strong>This</strong> note has been exposed for the<br />

public comments. The proposed Exposure Draft shall be<br />

modified in light of comments received before being issued<br />

in the final form. I request all of you to please submit your<br />

views/comments/suggestions on the same latest by<br />

October 10, 2011 to the CASB Secretariat. I also request the<br />

members to send their views on the Generally Accepted<br />

Cost Accounting Principles, which has been already<br />

exposed for public comments.<br />

Professional Development Activities<br />

Constitution of National Task Force on CARR & CAR<br />

I am glad to inform the members that the Institute has<br />

constituted a National Task Force (NTF) for actively<br />

pursuing the matters related to new notifications issued by<br />

the Cost Audit Branch, Ministry of Corporate Affairs<br />

relating to modified procedure of appointment of cost<br />

auditor, Cost Accounting Records Rules and Cost Audit<br />

Report Rules. The NTF consists of Past Presidents of ICWAI,<br />

many of whom were part of the Expert Group and it would<br />

deliberate upon all the recently issued orders/notifications.<br />

The mandate of NTF is to provide an action plan to<br />

the Council to ensure that the intent & objects of the<br />

notifications are clearly propagated. To address the queries<br />

relating to said notifications, the NTF constituted a<br />

The Management Accountant |September 2011 731

PRESIDENT’S PRESIDENT’S PRESIDENT’S COMMUNIQUÉ<br />

COMMUNIQUÉ<br />

COMMUNIQUÉ<br />

“Technical Cell” and the Institute has invited through<br />

its website queries from members on The Companies<br />

(Cost Accounting Records) Rules, 2011 (CARR) & The<br />

Companies (Cost Audit Report) Rules, 2011 (CAR). The<br />

queries in this may be directly addressed to Shri J.K.<br />

Budhiraja, Director (Professional Development) at email:<br />

pd.budhiraja@icwai.org. The queries received from<br />

members and industry will be addressed by the Institute<br />

by an updated Frequently Asked Questions (FAQ) through<br />

its website. I request respondents to the email groups not<br />

to provide any new interpretation on CARR & CAR other<br />

than that provided by the Institute in FAQs as it may lead<br />

to wrong interpretation of the notifications.<br />

Further, for imparting proper training and to upgrade the<br />

technical skills of our members in the industry and inpractice,<br />

the Institute Head Quarters in association with<br />

Regional Councils/ Chapters and local trade associations and<br />

chambers of commerce is going to conduct joint seminars/<br />

workshops on CARR & CAR soon. Many seminars and<br />

workshops are being held regularly and I also request them<br />

to organize study circle meetings also. I urge all Regional<br />

Councils/Chapters to conduct joint programmes and send<br />

the proposed list of such programmes to the Professional<br />

Development Directorate. Such programmes will also be<br />

available through webinars in future.<br />

Directorate of Advance Studies<br />

The Advance Studies Directorate has been working on the<br />

operational modalities and technicalities related to the post<br />

qualification courses announced for the members. The<br />

Directorate proposes to launch these programs by October,<br />

2011. All the three courses are designed as per the industry<br />

requirements. The directorate is also exploring the<br />

possibility of designing a course delivery mechanism jointly<br />

with reputed management institutions, based on the domain<br />

specialization of such institutions.<br />

CEP Directorate<br />

Programmes held during the month of August, 2011<br />

are as follows :<br />

1. Programme on Management of Taxation-Service Tax,<br />

VAT, Excise & Customs, TDS and Proposed GST &<br />

DTC held during 3-5 August, 2011 at Kolkata.<br />

2. Certificate course for three months duration (4 July –<br />

23 Sept., 2011) on the topic Finance, Accounting,<br />

Costing,<br />

Project and Contract Management, is being run at our<br />

office for Indian Navy.<br />

3. A programme on Finance and Accounts, 8-12 august,<br />

2011 for NHAI at Jaipur.<br />

4. Two programmes held at Madurai ‘Advance Tax, TDS<br />

& Tax Planning and Finance for Jr. Finance and AOs<br />

and Non Executives (Fin)’ during 9-12 August, 2011.<br />

5. A Seminar on Cost Accounting Standards held at<br />

Chennai on 12th August, 2011.<br />

6. Seminar on Proposed DTC and GST held at New Delhi<br />

during 18 & 19 August, 2011.<br />

7. 2nd batch of IFRS Certificate course held at Hyderabad<br />

during 24-28 August, 2011.<br />

8. A programme on Contract Management held on 29th<br />

August, 2011 for Lanco Power, Gurgaon.<br />

The Institute with Ministry of Corporate Affairs organized<br />

three programmes on XBRL at Delhi on 24th August, 2011,<br />

at Kolkata on 26th August, 2011 and at Chennai on 30th<br />

August, 2011. The same programmes are being held at<br />

Bangalore on 3rd September, 2011, at Hyderabad on 6th<br />

September, 2011. The program at Hyderabad would be<br />

webcast and Regional councils and Chapters across will be<br />

relaying this for the benefit of members .We propose to<br />

have National Seminar on XBRL during the first week of<br />

October, 2011 at Chennai .<br />

Proposals for organising programmes were submitted to :<br />

● M/o Railways for International programme<br />

● Indian Air Force for one month course.<br />

● Delhi Jal Board<br />

● ONGC for IFRS Programme<br />

Examination Results<br />

The results of the Institute examinations held in June 2011<br />

have been declared and I congratulate the successful<br />

candidates who have passed. I urge the others to work hard<br />

for better results in the ensuing examination. I also<br />

congratulate the rank holders in the examination.<br />

My best wishes to members and their families for the<br />

festivities of Akshaya Teej, Ganesh Chaturthi, onset of<br />

Navratris in the month of September, 2011.<br />

With regards,<br />

(M Gopalakrishnan)<br />

President, ICWAI<br />

2nd September, 2011<br />

732 The Management Accountant |September 2011

COVER COVER ARTICLE<br />

ARTICLE<br />

Hospitality Industry : An Insight<br />

Overview<br />

● The Indian hotel industry was estimated at USD<br />

17 billion at the end of 2010. Of the total revenue,<br />

nearly 70% is contributed by the unorganized sector<br />

and the remaining 30% comes from the organized<br />

sector. The hotel industry is estimated to grow at a<br />

CAGR of around 15% over the next five years.<br />

● The share of hotel and restaurant sector in the<br />

overall economy is still below 2%. For the last five<br />

years the total contribution of the hospitality sector<br />

has remained stagnant. Although the overall share<br />

increased from 1.46% in 2004-05 to 1.69% in 2007-08,<br />

after the phase of economic meltdown in US the total<br />

share again decreased to 1.45% in 2009-10.<br />

● According to Economic Survey of 2010-11 the<br />

average annual growth rate of hotel and restaurant<br />

sector has been 8.8% for the period 2005-06 to 2009–<br />

10. However, last two years have not been quite<br />

pleasant for the sector as growth faltered badly.<br />

● Till five years ago, the sector was registering a<br />

growth of around 15% but slowdown in the economy<br />

has affected the growth prospects of the sector badly<br />

and the growth rate has dropped to single digit level.<br />

● The sector registered negative growth (–3.41%)<br />

in 2008–09 over the year 2007–08, which was due to<br />

adverse global economic conditions in this year. But<br />

the sector is back in the positive growth territory and<br />

clocked a growth of 2.2% in 2009-10.<br />

Annual growth rate (%)<br />

Segment 2005-06 2006-07 2007-08 2008-09 2009-10<br />

Hotels &<br />

Restaurants 17.5 14.4 13.1 –3.4 2.2<br />

Source : Economic Survey 2010-11<br />

Sector Status<br />

● Several studies have highlighted the demandsupply<br />

gap in hotel rooms in India. Majority have<br />

estimated a gap of 1,50,000 hotel rooms. A greater<br />

need is being felt in the mid-market and budget hotels<br />

segment in which a shortfall of around 1,00,000 rooms<br />

Risk Management in Hospitality<br />

Industry—Role of CMAs<br />

P.K. Sinha*<br />

Sanchari Sinha**<br />

is estimated. Since the construction of hotels is capital<br />

intensive with a long gestation period, the government<br />

is making efforts to stimulate investments in this<br />

sector and speed up the approval process to attract<br />

private sector investments.<br />

● It is estimated that the room demand in the<br />

premium segment hotels in 10 major cities in India<br />

increased by around 5% since the past year. The room<br />

demand in India is expected to grow by approximately<br />

10% over the next five years.<br />

● According to the statistics by World Travel and<br />

Tourism Council, India ranks 18th in business travel<br />

and will be among the top 5 in this decade. With such<br />

growth, sources estimate, demand is going to exceed<br />

supply by at least 100% in coming years.<br />

Number of Hotels — 2010<br />

Hotel categories No. of Hotels No. of Rooms<br />

5 star deluxe/5 star 165 43,965<br />

4 Star 770 13,420<br />

3 Star 505 30,100<br />

2 Star 495 22,950<br />

1 Star 260 10,900<br />

Heritage 70 4,200<br />

Uncategorized 7,078 —<br />

Total<br />

Source: FHRAI<br />

8,707 1,32,885<br />

● Although organized sector contributes only onethird<br />

of revenue of the overall revenue of the industry,<br />

several well known hotel chains have lined up<br />

aggressive expansion plans for India.<br />

● The foremost contribution of the organized hotel<br />

industry comes from 5 star hotels. Despite a dip in<br />

* M.Com, LLB, ACA, FICWA, ACIS (London), ACS, Post<br />

Graduate in Management Accounting (ICA) and Ph.D.<br />

in Management; Director, Zeal Institute of Management<br />

& Computer Applications, Pune.<br />

** MBA, Symbiosis (Pune), an M.Sc.(Econ) U.K.;<br />

Research Associate in an International Consulting Firm<br />

in Pune<br />

The Management Accountant |September 2011 733

the year 2009, average growth rate of 8% augurs well<br />

for the hotel industry.<br />

● Currently, the industry is adding about 60,000<br />

quality rooms which are in different stages of planning<br />

and development and should be ready by 2012.<br />

● An upward trend in the growth of the overall<br />

hotel sector is expected in the next few years, whereby<br />

the industry is expected to grow to USD 36 billion by<br />

2018.<br />

Operating performance<br />

● The hotel industry in India is recovering from<br />

the blows it suffered in 2008, first due to financial<br />

meltdown in America in September and later due to<br />

terrorist attack on the two 5-Star hotels—Taj and<br />

Oberoi in Mumbai.<br />

● The onset of the global economic slowdown had<br />

a greater impact on the profitability of the sector<br />

determined by the occupancy rate. The occupancy rate<br />

came down from 69% in 2007-08 to 60% in 2008-09. It<br />

was hovering above 71% before the incidents. Average<br />

room rates (ARRs) saw a marginal decline of about<br />

2% during that time. As the occupancy rates were<br />

badly hit, overall revenue per room (RevPAR) fell by<br />

14% in 2008-09.<br />

● The swine flu outbreak in 2009 further eroded<br />

the profitability. ARRs fell 25% and ORs plunged to<br />

53% in the first half of 2009-10. By then, hotels were<br />

doling out generous discounts in a bid to fill up their<br />

rooms even as RevPARs declined by 30-40%.<br />

Nationwide performance<br />

Year Occupancy % change Average %change Revenue %change<br />

Rate Room Rate Room<br />

2005-06 71.5 3.6 Rs 5,444 26.6 Rs 3,892 31.2<br />

2006-07 71.4 –0.1 Rs 7,071 29.9 Rs 5,049 29.7<br />

2007-08 68.8 –3.6 Rs 7,989 13.0 Rs 5,496 8.9<br />

2008-09 60.3 –12.4 Rs 7,837 –1.9 Rs 4,726 –14.0<br />

2009-10 65.0 7.8 Rs 6,426 –18.0 Rs 4,177 –11.6<br />

2010-11 68.0 4.6 Rs 6,800 5.8 Rs 4,624 10.7<br />

Source : HVS<br />

COVER COVER ARTICLE<br />

ARTICLE<br />

● After 3% decline in 2009, foreign tourist arrivals<br />

(FTAs) to India saw a heartening 9.3% increase during<br />

2010. The inflows of tourists continued in 2010-11. As<br />

a result, ARRs have increased by 10-15% in the past<br />

one year. The RevPAR increased to Rs 4,624 but still<br />

is way short of the revenue clocked by hotels in the<br />

year prior to the crisis.<br />

● Of the 60,000 rooms that are due for opening by<br />

2015, Pune, Chennai, Bangalore and Delhi are likely<br />

to see maximum increase in supply.<br />

Financials<br />

● In 2011-12 demand revival and occupancy rates<br />

will result in higher profits for the hospitality sector :<br />

Revenues Net Profit E V/E B I D T A<br />

(Rs crore) (Rs crore) (X)<br />

FY’ FY’ FY’ FY’ FY’ FY’ FY’ FY’ FY’<br />

10 11E 12# 10 11E 12E 10 11E 12E<br />

Indian Hotels 2457 2985 3633 –137 86 274 23 18 12<br />

EIH 845 1144 1363 66 69 161 27 20 15<br />

Taj GVK Hotels 228 266 315 26 45 59 13 8 6<br />

Hotel Leelaventure 430 540 769 41 56 81 35 22 14<br />

Source: Bloomberg<br />

Hotels — classification<br />

Presently there are 1,593 classified hotels with a<br />

capacity of 95,087 rooms in the country. The hotel<br />

sector comprises various forms of accommodation —<br />

star category hotels, heritage category hotels,<br />

timeshare resorts, apartment hotels, guest houses, and<br />

bed and breakfast establishments. Based on this the<br />

hotels in India are classified into the following<br />

segments :<br />

I. Star rated hotels (5 Star and Star Deluxe)<br />

● Mainly situated in the business districts of metro<br />

cities and cater to business travelers and foreign<br />

tourists.<br />

● Considered to be very expensive and account<br />

for about 30% of the industry.<br />

● Star hotels are further classified into six categories :<br />

Five Star Deluxe, Five Star, Four Star, Three Star,<br />

Two Star & One Star<br />

(a) Five Star Deluxe & Five Star : These are restricted<br />

to the four metros and some major cities like<br />

Bangalore and Hyderabad. The customers of these<br />

hotels are mostly foreign business and leisure<br />

travelers, senior business executives and top<br />

government officials.<br />

(b) Three Star & Four Star : These are located in all<br />

major cities as well as tourist destinations. Their<br />

customer group ranges from mid-level business<br />

executives to leisure travelers.<br />

(c) One Star & Two Star : These are located in<br />

major cities as well as in small cities and other tourist<br />

destinations. Their customers usually include the<br />

domestic tourists.<br />

● Major players in this segment are Taj, Welcome<br />

Group, EIH and Oberoi. Apart from Indian players<br />

some of the international hotels also have their<br />

734 The Management Accountant |September 2011

presence in this segment. These include, Best Western,<br />

Choice hotels, Bass Hotels, Park Plaza and Carlson<br />

Hospitality.<br />

● Room supply in the 5-Star segment has grown at<br />

5% CAGR over the past decade while the 3 and 4 Star<br />

categories have grown at 6% and 8% CAGR,<br />

respectively, during the same period.<br />

II. Heritage hotels<br />

● Characterized by less capital expenditure and<br />

greater affordability and include running hotels in<br />

palaces, castles, forts, hunting lodges, etc.<br />

● Further classified as Heritage Classic (hotels built<br />

between 1920 and 1935), Heritage Grand (hotels built<br />

prior to 1920) and Heritage (hotels built between 1935<br />

and 1950).<br />

III. Budget hotels<br />

● Cater mainly to domestic travelers who favor<br />

reasonably priced accommodations with limited<br />

luxury.<br />

● Characterized by special seasonal offers and good<br />

services.<br />

IV. Unclassified hotels<br />

● Low-priced motels spread throughout the<br />

country.<br />

● A low-pricing policy is their only selling point.<br />

● <strong>This</strong> segment accounts for about 19% of the<br />

industry.<br />

V. Resorts and Clubs<br />

● Located at the outskirts of city—could be from<br />

premium to budget category.<br />

VI. Restaurants<br />

● Food chains and outlets set up in India. They are<br />

usually by international chains like Dominos,<br />

Espresso, Pizza Hut and McDonalds.<br />

Key players<br />

Company<br />

Indian Hotels<br />

ITC Welcomgroup<br />

EIH<br />

Carlson<br />

Inter Continental<br />

Source : IBEF<br />

COVER COVER ARTICLE<br />

ARTICLE<br />

Type of properties<br />

Luxury, mid-segment<br />

and budget<br />

Luxury, budget and<br />

heritage hotels<br />

Business hotels, leisure<br />

hotels and cruises<br />

Luxury, business hotels,<br />

economy and cruises<br />

Luxury, mid-segment<br />

and business hotels<br />

Brands<br />

Taj, Gateway, Vivanta and<br />

Ginger<br />

ITC Hotel—Luxury<br />

Collection, Welcom Hotel<br />

—Sheraton, Fortune and<br />

WelcomHeritage<br />

Oberoi and Trident<br />

Radisson Hotels and<br />

Resorts, Park Plaza,<br />

Country Inns & Suites,<br />

Park Inn<br />

Inter Continental, Crowne<br />

Plaza, Holiday Inn, Holiday<br />

Inn Express, Hotel<br />

● In the Indian hospitality industry the major<br />

players are Indian Hotels, EIH, ITC hotels, Hotel Leela<br />

Ventures, Bharat Hotels and Asian Hotels, ITDC and<br />

Orient Hotels Ltd.<br />

● The booming industry has attracted many<br />

international players as well. A number of global<br />

players are already well established in India. These<br />

include Hilton, Shangri-La, Radisson, Mariott,<br />

Meridian, Sheraton, Hyatt, Holiday Inn, Inter<br />

Continental and Crown Plaza.<br />

● The country has been flooded by some of the<br />

world’s leading hotel brands. New brands such as<br />

Amanda, Satinwoods, Banana Tree, Hampton Inns,<br />

Scandium by Hilt and Mandarin Oriental are planning<br />

to enter the Indian hospitality industry in joint<br />

ventures with domestic hotel majors.<br />

International Hotel Brands<br />

Brand No. of hotels Target date<br />

Carlson 50 2012<br />

Four Seasons 6 2012-13<br />

Starwood 15 2012<br />

Hyatt 10 2012-13<br />

Marriott 24 2012<br />

Wyndham 50 2011<br />

Hilton 75 2015<br />

Intercontinental 41 2012<br />

Fairmont Raffles 15 2012-13<br />

Accor 44 2012<br />

Source : Business Standard<br />

Latest trends<br />

Investment in smaller cities<br />

● Rising business and leisure travel to smaller cities<br />

such as Udaipur, Thiruvananthapuram, Bhubaneswar,<br />

Pune, Kochi and Chandigarh have increased<br />

demand for quality hotel rooms in these cities.<br />

Hospitality chains are expected to increase their<br />

presence in smaller cities to leverage this opportunity.<br />

There are plans for a suitable project mix (more<br />

budget/business hotels compared to luxury hotels)<br />

for these cities. For instance, Carlson has announced<br />

its plans to set-up mid-segment hotels in Tier II and<br />

Tier III cities.<br />

Diversification into new segments<br />

● Many hospitality chains that were earlier focused<br />

only on the luxury segment are now diversifying into<br />

new product segments, such as budget hotels and<br />

serviced apartments, in order to reduce risks.<br />

● IHCL has already launched budget hotels in<br />

India, while Accor has announced plans to introduce<br />

its budget hotel brand, Formule1, in the country.<br />

The Management Accountant |September 2011 735

COVER COVER ARTICLE<br />

ARTICLE<br />

● Hotel chains are diversifying into niche segments<br />

such as medicities, wildlife lodges and spas to<br />

establish additional revenue generation streams.<br />

These segments also help hotel chains retain<br />

customers and provide them with value added<br />

services. For instance, IHCL operates wildlife lodges<br />

under the brand Taj Safari, a JV between IHCL and<br />

Beyond, an Africa-based safari and ecotourism<br />

company. ITC-Welcomgroup and IHCL operates spas<br />

at some of their luxury properties.<br />

Regulations & Taxation<br />

● In the Hotel Industry Sector, Foreign Direct<br />

Investment (FDI) has been permitted up to 100%<br />

under the automatic route. For foreign technology<br />

agreements, automatic approval is granted if :<br />

1. Up to 3% of the capital cost of the project is<br />

proposed to be paid for technical consultancy<br />

services.<br />

2. Up to 3% of the net turnover is payable for<br />

franchising and marketing/publicity fees.<br />

3. Up to 10% of gross operating profit is payable<br />

for management fees including incentives fees.<br />

Tax Holiday<br />

● A deduction of an amount equal to 100% of the<br />

profit and gain for the first 5 consecutive years to an<br />

undertaking deriving profits from the business of a<br />

hotel or from the business of building, owning and<br />

operating a convention centre, in specified areas, if<br />

such hotel/convention centre is constructed and has<br />

started or starts functioning before July 31, 2010.<br />

● A deduction of an amount equal to 100% of the<br />

profit and gain for the first 5 consecutive years to an<br />

undertaking derived profit from the business of a hotel<br />

located in the specified district having a World<br />

Heritage Site—if such a hotel is constructed and has<br />

started functioning before March 31, 2013.<br />

Challenges—Opportunities for Growth<br />

The following table highlights the challenges to the<br />

hospitality sector in India, which will serve as<br />

opportunities for growth :<br />

Source: Critical <strong>Issue</strong>s Facing Indian Hospitality, An HVS<br />

White Paper, HVS Hospitality Services, January 2009<br />

Hospitality Industry : Risks & Risk Management<br />

Strategies—Role of CMAs<br />

● Hospitality industry, which depends entirely on<br />

the services it offers, should be able to identify and<br />

manage its risks effectively.<br />

● There are many functions in the hotel industry<br />

which involve use of chemicals and hazardous<br />

materials (dry cleaning, LPG and HSD storage, plating<br />

and polishing). Food contamination and environmental<br />

releases are some of the other hazards<br />

associated with hotel operations.<br />

● While control of physical risks is important,<br />

liability with respect to services provided should not<br />

be overlooked. Considering that a large number of<br />

guests are from overseas, there is an urgent need to<br />

look at liability from all angles and adequate control<br />

measures need to be taken.<br />

● A risk spectrum highlighting key risks associated<br />

with hotel operations is depicted in the following<br />

figure :<br />

Source : Cholamandalam MS Risk Services, Risk<br />

Assessment—Hotel Industry, The CMSRSL Approach<br />

● Lack of understanding, coupled with inadequate<br />

basic management controls over key business risks<br />

has been the root cause of many failures that have<br />

been witnessed in the past in hotel operations. Thus,<br />

effective risk management is critical to the hospitality<br />

industry.<br />

● Risk assessments, increasingly used by international<br />

as well as large industrial operations, involves<br />

timely identification of significant risk and its<br />

evaluation to determine the type and level of control<br />

that should be established to result in an acceptable<br />

level of risk to the business.<br />

● Hazards should be identified. <strong>This</strong> identification<br />

process yields a large number of risk events. In order<br />

to prioritize the action in dealing with significant risks,<br />

a consistent method is required to evaluate each one.<br />

● The consequence, likelihood and exposure of<br />

each hazard are arrived at using a systematic<br />

approach. <strong>This</strong> will help to determine the relative<br />

importance of hazard and focus on significant risks.<br />

736 The Management Accountant |September 2011

COVER COVER ARTICLE<br />

ARTICLE<br />

For combining consequence, likelihood and exposure<br />

of hazard, CMAs help companies by designing risk<br />

calculators.<br />

● The risk calculator allows comparison of several<br />

types of risks on the same scale including individual,<br />

societal, economic, health, and environmental risks.<br />

● CMAs help organizations in developing a privacy<br />

strategy which should be at the top of every chief<br />

executive’s risk agenda. The four major benefits from<br />

this privacy strategy are :<br />

— One way for a company to separate itself from<br />

competition<br />

— Can mitigate risk, be it brand, reputation,<br />

customer trust, litigation, or compliance<br />

— Help ensure that the privacy processes and<br />

practices are cost-effective<br />

— Desirable, if for no other reason than to protect<br />

a company’s own intellectual capital and<br />

customer lists.<br />

● A successful, well-executed strategy can bring<br />

about increased customer comfort and, ultimately,<br />

higher revenue.<br />

● Successful organizations take calculated risks to<br />

achieve their objectives. They weigh opportunities<br />

against threats and act decisively. In other words, risk<br />

management can become a strategic competitive<br />

advantage to help hospitality organizations shift their<br />

focus from crisis response and compliance to<br />

evaluating risks in business strategies proactively.<br />

● CMAs recommend some of the following critical<br />

success factors in a hospitality organization’s risk<br />

management program :<br />

— Need to create a risk-aware culture throughout<br />

the organization<br />

— Establish risk management objectives that are<br />

measurable and establish accountability<br />

— Establish an infrastructure for risk management<br />

— Empower business areas/departments to be<br />

responsible for managing risk in accordance<br />

with the organization’s risk management<br />

approach—reward risk optimization initiatives<br />

— Communicate commitment to risk optimization<br />

by the board and its committees<br />

— Communicate and train management and staff<br />

in risk identification and avoidance techniques<br />

— Continually identify and fill gaps in the risk<br />

management process.<br />

● Hotel guests demand high quality goods and<br />

services at competitive prices. While investors expect<br />

outstanding performance and growth from their<br />

stocks this puts heavy pressure on hotel owners,<br />

boards, and management, who can no longer rely on<br />

old, established strategies and practices. They need<br />

to do a better job of taking and managing risks both<br />

at the property level and at the enterprise level. Risk<br />

management is so important that CMAs suggest to<br />

invest in a structured technology-enabled approach<br />

to risk optimization.<br />

● CMAs believe that risks can only be managed<br />

and optimized if they are identified. Today’s business<br />

environment demands it.<br />

Need for ‘Business Interruption Insurance’<br />

● The hospitality industry is more vulnerable to<br />

economic fluctuations when compared to other<br />

industries as there are various risks involved in<br />

running a hospitality business. However, as with any<br />

other industry, the risk of losses from unforeseen<br />

events such as hurricanes, earthquakes, flooding, fire,<br />

etc., clearly remains.<br />

● It is thus very important for hospitality<br />

operations to take reasonable steps to protect their<br />

property, employees and financial circumstances.<br />

Many businesses in this industry are aware of such<br />

widespread losses and would never consider opening<br />

a business without buying property and liability<br />

insurance policies. But many of them, particularly<br />

small businesses, fail to think about how they would<br />

manage if any interruption occurs to their business<br />

for many days.<br />

● Suppose an unforeseen event such as fire or flood<br />

makes the business place temporarily unusable,<br />

relocates the business or shuts it down for a while. A<br />

regular commercial property insurance policy covers<br />

only the physical damage to one’s business. What<br />

about the profits which could have been earned<br />

during this period? How would one pay rent,<br />

employees’ salaries and other important payments<br />

while one’s business is being rebuilt? <strong>This</strong> would<br />

definitely result in substantial financial loss.<br />

● Many businesses without the ‘Business Income<br />

Coverage’ shut down their business operations after<br />

their business is completely shuttered due to some<br />

unforeseen event. ‘Business Income Coverage’ covers<br />

the loss of income and helps a business return to the<br />

financial position as it was in prior to the disaster.<br />

● CMAs suggest that a business in the hospitality<br />

industry should understand the importance of<br />

‘Business Interruption Insurance’ and should go for<br />

this insurance.<br />

The Management Accountant |September 2011 737

COVER COVER ARTICLE<br />

ARTICLE<br />

● Business owners from hospitality industry<br />

should be aware of some of the critical aspects of<br />

‘Business Interruption Insurance’. Given below are<br />

some critical aspects of hotel ‘Business Interruption’<br />

coverage and its usefulness for businesses in the<br />

hospitality sector :<br />

Business interruption period : The business<br />

interruption period is the length of period for which<br />

benefits are payable under an insurance policy. <strong>This</strong><br />

period is the most critical part of quantifying the<br />

business interruption loss. It covers a business from<br />

loss of income for a specified period till the damaged<br />

business property is repaired or reopened. Some<br />

hotels—being aware of the losses that may persist even<br />

after repairs are done—opt for “extended period of<br />

indemnity”. As, it may take some time for the hotel<br />

to regain bookings and rebuild market share.<br />

Loss of room revenues : The business in the<br />

hospitality or the lodging industry may suffer financial<br />

performance as two of its main functions—occupancy<br />

percentage and average daily rate (ADR)—may get<br />

affected. In simpler terms, a hotel damaged by a<br />

hurricane or fire or stuck in a deep local recession<br />

will not be able to generate any revenue because of<br />

closed rooms, especially in case of hotels and lodges.<br />

‘Business Interruption Insurance’ compensates for lost<br />

income due to loss of rooms. It covers the profits one<br />

would have earned, based on one’s financial records.<br />

Other lost revenues : Revenues from food and<br />

beverage, conferences, golf, spa, etc. can constitute a<br />

significant portion of a hotel’s income. When a<br />

business is interrupted, not only revenues through<br />

rooms are affected, some or all of these sources<br />

of income are typically interrupted. ‘Business<br />

Interruption Insurance’ covers all the profits that<br />

would have been earned.<br />

Ordinary payroll : Even if the business activities<br />

are temporarily stalled, operating expenses, and other<br />

costs such as rent, electricity bill, taxes, interest<br />

payable on bank loans, payroll costs etc., cannot be<br />

ignored. The business still needs to retain some<br />

employees such as accountants, front office executives<br />

etc. The business owner needs to pay salaries to them.<br />

In this kind of situation ‘Business Interruption<br />

Insurance’ is very helpful as ordinary payroll coverage<br />

is a common endorsement in many policies.<br />

Extra expenses : Business interruption policies<br />

generally allow an insured hotel to claim extra<br />

expenses incurred during the period of indemnity. It<br />

reimburses for reasonable expenses that allow the<br />

business to continue operation while the property is<br />

being rebuilt. Some policies also cover the extra costs<br />

required for moving the business to a different<br />

(temporary) location.<br />

Conclusion<br />

● Hospitality industry is one of the major service<br />

sectors and employers across many economies in the<br />

world.<br />

● India—known globally as the land of hospitality—is<br />

today in the defining stages of the business<br />

of hospitality. The Indian Hospitality Industry is one<br />

of the fastest growing sectors of the Indian economy.<br />

Riding on economic growth and rising income levels<br />

that India has witnessed in recent years, the sector<br />

has emerged as one of the key sectors driving the<br />

country’s economy.<br />

● There are, however, many risks involved in<br />

running hospitality business and CMAs advice<br />

business owners to be aware of these in order to assess<br />

their insurance needs. CMAs suggest organizations<br />

to invest in a structured technology enabled approach<br />

to risk optimization.<br />

● A well-thought out risk strategy by hotel owners<br />

or operators can make a significant difference at the<br />

most crucial times.<br />

● ‘Business Interruption Insurance’ is one of the<br />

most important insurance policy that helps in<br />

minimizing the adverse consequences of some<br />

unwanted events for businesses in the hospitality<br />

industry. Business owners from the hospitality<br />

industry should be aware of some of the critical<br />

aspects of ‘Business Interruption Insurance’ for<br />

putting them in practice.<br />

References<br />

■ Cholamandalam MS Risk Services, Risk Assessment<br />

—Hotel Industry, The CMSRSL Approach.<br />

■ Critical <strong>Issue</strong>s Facing Indian Hospitality, An HVS White<br />

Paper, HVS Hospitality Services, January 2009.<br />

■ Hospitality Industry—An Insight, India Biznews, June<br />

13, 2011.<br />

■ Risk Management Strategies for the Hospitality Industry,<br />

Leonard Queiroz, KPMG, July 17, 2001.<br />

■ The top 10 risks for business—A sector-wide view of<br />

the risks facing business across the globe, Ernst & Young.<br />

■ Global Hospitality Insights—A publication for the<br />

hospitality industry, Top thoughts for 2011, Ernst &<br />

Young.<br />

738 The Management Accountant |September 2011

COVER COVER ARTICLE<br />

ARTICLE<br />

Hospitality Industry, Hospitality Management<br />

and Role of CMA to develop them<br />

Hospitality is the act of entertaining, providing<br />

comfortable facilities to guests, visitors,<br />

customers or any other associated person at<br />

hotels, motels, resorts, clubs, restaurants, tourist<br />

places, business places, airports, railway station, bus<br />

terminus, shopping malls, amusement parks, theatre<br />

halls etc.<br />

Hospitality is now considered to be a first growing<br />

industry. Hospitality management has to ensure better<br />

services in the following areas.<br />

● Accommodations<br />

● Food and beverage<br />

● Organising events<br />

● Organising games and sports<br />

● Organising cultural functions<br />

● Tourism services<br />

● Information required by visitors.<br />

● Hospitality industry has the manyfold potential<br />

to contribute to the economy by —<br />

● Contribution to GDP<br />

● Employment generation<br />

● Foreign exchange earning<br />

● Earning of tax revenues<br />

The World Tourism Organisation (UNWTO)<br />

forecasts that the international tourism will grow at<br />

the average annual rate of 4% [ Source - Long term<br />

prospects : Tourism 2020 Vision ,World Tourism].<br />

Many countries have attempted to build their<br />

international tourism industry because of its potential<br />

to contribute to the national economy through foreign<br />

exchange earnings. A strong association between<br />

international tourism development and economic<br />

performance is hence generally assumed and has been<br />

found in Taiwan. Research studies reported that the<br />

tourism industry was one of major contributors to<br />

Taiwan’s economic growth. Chen et al. (2009), Kim et<br />

al. (2006) and Jang and Chen (2008) revealed that the<br />

tourism sector has contributed more than the<br />

agriculture sector to the gross domestic product<br />

(GDP) in Taiwan. According to the World Travel and<br />

Tourism Council (2009), the aggregate tourism<br />

earnings accounted for 3.46% and 3.34% of Taiwan’s<br />

GDP in 2007 and 2008, respectively. The World<br />

Economic Forum (2009) indicated that Taiwan’s<br />

foreign exchange earning from tourism was US$5.1<br />

Ashoke Kumar Bothra*<br />

billion in 2007 and represented 1.34% of the GDP,<br />

which is higher than the corresponding figures in the<br />

US, Canada, Germany, Japan, South Korea and<br />

China.Kirn et al. (2006) and Chen and Chiou-Wei<br />

(2009) further showed that international tourism<br />

development in Taiwan could promote economic<br />

growth. [Source- International Journal of Hospitality<br />

Management 30(2011) ]<br />

The growth and development of Hospitality<br />

industry vis-a-vis tourism is intensely dependent on<br />

the advancement and the guiding principles of<br />

Hospitality management. Tourism industry in<br />

repercussion helps to grow —<br />

● Hotel industry<br />

● Air, water and land transports<br />

● Tourism services<br />

● Tourist places<br />

● The domestic and foreign markets of local arts<br />

and crafts<br />

The challenges lying in the growth of tourism is<br />

concerned with huge capital deployment and overall<br />

development of infrastructure, which needs a long<br />

term goal. The economic challenges become<br />

commercially viable and acceptable when the same<br />

is globally competitive by introducing a wide range<br />

of measures to improve operational efficiency. CMAs<br />

have a very big role here. They are capable to apply a<br />

number of Cost and management techniques such as,<br />

● Just-In-Time<br />

● Inventory Management<br />

● Budgeting<br />

● Cost-Volume-Profit Analysis<br />

● Linear Programming<br />

● Queuing theory<br />

● Risk Management<br />

● Activity Based Costing<br />

Just-in-time — <strong>This</strong> concept is useful in hospitality<br />

industry at the time of organising big events, like a<br />

conference, a meet on festival, a concert, sports and<br />

games etc. If the different activities are well planned in<br />

advance and the requirements of different inputs are<br />

arrangec in systematic way one can minimise the<br />

carrying cost and wastage and thereby saving ir input<br />

cost.<br />

* FICWA, Practising Cost Accountant<br />

The Management Accountant |September 2011 739

COVER COVER ARTICLE<br />

ARTICLE<br />

Inventory management — Analysing different<br />

goods according to their requirement and value and<br />

application of perpetual inventory control can help<br />

in reducing the carrying cost and wastage of<br />

inventory. As the hospitality industry is seasonal in a<br />

number of cases, so studying the flow of demand and<br />

lean consumption of goods, helps to control unwanted<br />

cost. Improvement in the quality of output, can be<br />

done by inspection, testing, reviewing the process<br />

from time to time.<br />

Budgeting — <strong>This</strong> is a very common and easy tool<br />

to improve efficiency and helps in pricing decision.<br />

In case of hospitality industry event management<br />

budget with reasonable accuracy can be a pricing tool<br />

in future.<br />

Cost-Volume Profit Analysis — Also known as<br />

Break Even Analysis to find capacity at which the<br />

enterprise has neither profit nor loss. CVP analysis<br />

helps the management to take decision in different<br />

situation whether it is a loss making or a growing<br />

enterprise. During the period of global recession,<br />

which is still supposed to be continuing, almost all<br />

the airline companies are unable to meet their cost.<br />

CVP is useful tool in pricing, capacity expansion and<br />

survival decision.<br />

Linear Programming — Pricing is market-driven,<br />

not cost based in hotel industry. When a hotel chain<br />

is to set its prices, it starts with comprehensive market<br />

research. Based on the data, the correct price for each<br />

marketplace and each category of room is determined<br />

with the help of linear programming. If there is a major<br />

shift in a market, then the prices will adjust for that.<br />

However, if there is a major shift in a demand curve,<br />

then a shift of price may have no effect. It may actually<br />

leave more money on the table. For example, if an<br />

airline goes on strike, a significant shift in the demand<br />

curve would result. Under such conditions, increasing<br />

the rate would have beneficial result. If there is an<br />

opportunity to go after a new targeted market with a<br />

specific offer, enabling the chain to capture a greater<br />

market share, then lowering the rate serves its<br />

purpose. Generally, however, lowering rates across<br />

the board is not a preferred pricing strategy.<br />

Queuing theory — In restaurants and bars in the<br />

situation of queuing may cause to dissatisfaction of<br />

customers resulting business loss. To handle queuing<br />

problem, data on footfall of the number of customers<br />

and their wants with time are collected and studied.<br />

Data may be collected on different parameters like<br />

customers with family, officials, tourist and verities<br />

in their choice. Seasonal change in the pattern of<br />

customers visit, seasonal impact on variation in<br />

number of customers, can be analysed with the help<br />

of statistical tools.<br />

Risk management — One of the root causes why<br />

the hospitality industry is so less developed is that<br />

the huge risks associated with it. The risk may be —<br />

● Change in government policy<br />

● Change in foreign policy<br />

● Attack or threat of terrorism<br />

● Strike by Airlines<br />

● Spread of epidemic<br />

● Economic recession<br />

● Fire and natural calamities<br />

Most of risk factors are external and therefore<br />

impossible to contain with or managed by human<br />

effort. However we can minimise and avoid risk by<br />

systematic planning and decision making. Risk<br />

management is based on following principle —<br />

● Acceptance of risk if the benefit is more than<br />

risk cost<br />

● Avoid unnecessary risk<br />

● Take risk decision at the right level and right<br />

time<br />

● Manage the risk by planning.<br />

Trade off between risk and return - Risk and return<br />

are positively correlated .Higher the risk, higher is<br />

the return. Risk/return trade off is the balancing act<br />

between risk and return. The important point here is<br />

that to ascertain the cost of accepted risk level; and if<br />

the return is higher than the cost of accepted risk level<br />

the same is beneficial. At the time of recession tourist<br />

service provider allows high discount to the customer<br />

in anticipation of higher demand. So there is a cost of<br />

allowing discount in one hand and some extra revenue<br />

generated on the other. If the revenue generated is<br />

more, it is beneficial to the service provider. Another<br />

long term benefit derived by the service provider is<br />

the growth in market share which may be a strategic<br />

advantage in the long run.<br />

Activity Based Costing — Implementation of ABC<br />

methodology is not easy but it is a very effective<br />

managerial tool. Tourism industry is in fact a<br />

combination of a number of activities those can be<br />

identified, such as —<br />

● Air transport<br />

● Land Transport<br />

● Water Transport<br />

● Pick up facility to the tourist<br />

● Lodging facility<br />

● Food and Beverages<br />

● Camping<br />

● Supporting transport<br />

● Travel agency function<br />

740 The Management Accountant |September 2011

● Guide Providing<br />

● Entertainment facility<br />

● Cultural activity<br />

● Recreational activity<br />

● Games and sports activity<br />

● Sight seeing facility<br />

COVER COVER ARTICLE<br />

ARTICLE<br />

● Drop facility to Airport, etc.<br />

ABC is applicable throughout financing, accounting,<br />

costing, pricing, budgeting and beyond them.<br />

The benefits of ABC can be summarised below —<br />

● Better Management<br />

● Budgeting, performance measurement<br />

● Calculating costs more accurately<br />

● Ensuring activity specific profitability<br />

● Evaluating and justifying investments in new<br />

area<br />

All the Regional Directors,<br />

All the Registrar of Companies/Official Upuidators<br />

All shareholders<br />

● Improving service quality via better system<br />

design<br />

● Increasing competitiveness or coping with more<br />

competition<br />

● Managing costs<br />

● Providing behavioural incentives by creating<br />

cost consciousness among employees<br />

● Responding to an increase in overheads<br />

● Responding to increased pressure from<br />

regulating agencies.<br />

Finally, one must say that when the national<br />

economy is under the grip of inflation and the global<br />

economy, specifically the US and European economy<br />

are still struggling with recession and put a question<br />

mark on growth, hospitality industry with better<br />

measures of hospitality management can bring the<br />

global economic activities in the path of growth. ❐<br />

No. HQ/MCA/Digitised/AR/2009<br />

Government of India<br />

Ministry of Corporate Affairs<br />

Circular No. : 57/2011<br />

5th Floor, ‘‘A’’ Wing, Shastri Bhawan,<br />

Dr. R. P. Road, New Delhi-110001<br />

Dated : 28.07.2011<br />

Sub : Filing of Balance Sheet and Profit and Loss Account in extensible<br />

Business Reporting Language (XBRL) mode.<br />

Sir,<br />

The Para 3 of the Circular No. 37/2011 dated 07.06.2011 may be read as under :<br />

‘‘All companies falling in Phase-I class of companies (excluding exempted class) are permitted to file<br />

their financial statements without any additional fee up to 30.11.2011 or within 60 days of their due date,<br />

whichever is later.’’<br />

Further, in supersession of Para 2 (i) of Ministry’s Circular No. 43/2011 dated 07.07.2011, it is informed<br />

that the verification and certification of the XBRL document of financial statements on the e-forms would<br />

continue to be done by authorized signatory of the company as well as professional like Chartered Accountant<br />

or Company Secretary or Cost Accountant in whole time practice.<br />

<strong>This</strong> issue with approval of Competent Authority.<br />

Yours faithfully,<br />

(J. N. Tikku)<br />

Joint Director<br />

The Management Accountant |September 2011 741

COVER COVER ARTICLE<br />

ARTICLE<br />

Role of CMAs towards Hospitality Management<br />

in Hospitality Industry<br />

Swapan Kumar Roy*<br />

Indian tourism and hospitality sector has reached<br />

new heights today. Hospitality industry is closely<br />

linked with travel and tourism industries. The<br />

boom in the tourism industry has resulted in the<br />

immense growth of hotel industry in India. It is<br />

attracting tourists from across the world. Domestic<br />

tourists also get attracted. All these act as a vehicle<br />

for establishing a relation with other countries.<br />

Cultural development takes place. The country’s<br />

economy is developed. The industry employs millions<br />