The terms used by participants in the Forex market can be confusing for novice traders. But everyone who comes to the exchange to earn money should understand these concepts. Below we will look at such key concepts as leverage and lot size on Forex, and find out what pips are.

The article covers the following subjects:

Major takeaways

- The article discusses key concepts in Forex trading, specifically focusing on the relationship and differences between leverage and lot size.

- Leverage and lot size are different concepts in Forex, but they are related.

- Leverage is a tool that allows traders to manage a larger position with a smaller amount of their own funds, effectively increasing potential profits and losses.

- The article also discusses the concept of a lot, which is a standard unit of measurement in Forex trading.

Leverage and Lots in Forex

Leverage vs lot size are different concepts on Forex, but there is a certain connection between them. Let's figure out what are leverage and lots means.

Leverage means that the trader borrows funds from their Forex broker or a related third party. With this financial support, they can open trades more effectively than without leverage.

Now let's define the concept of lot on Forex.

Lot is a contract measured in base currency units. So the number of lots or portions of a lot determines the size of the opened trade.

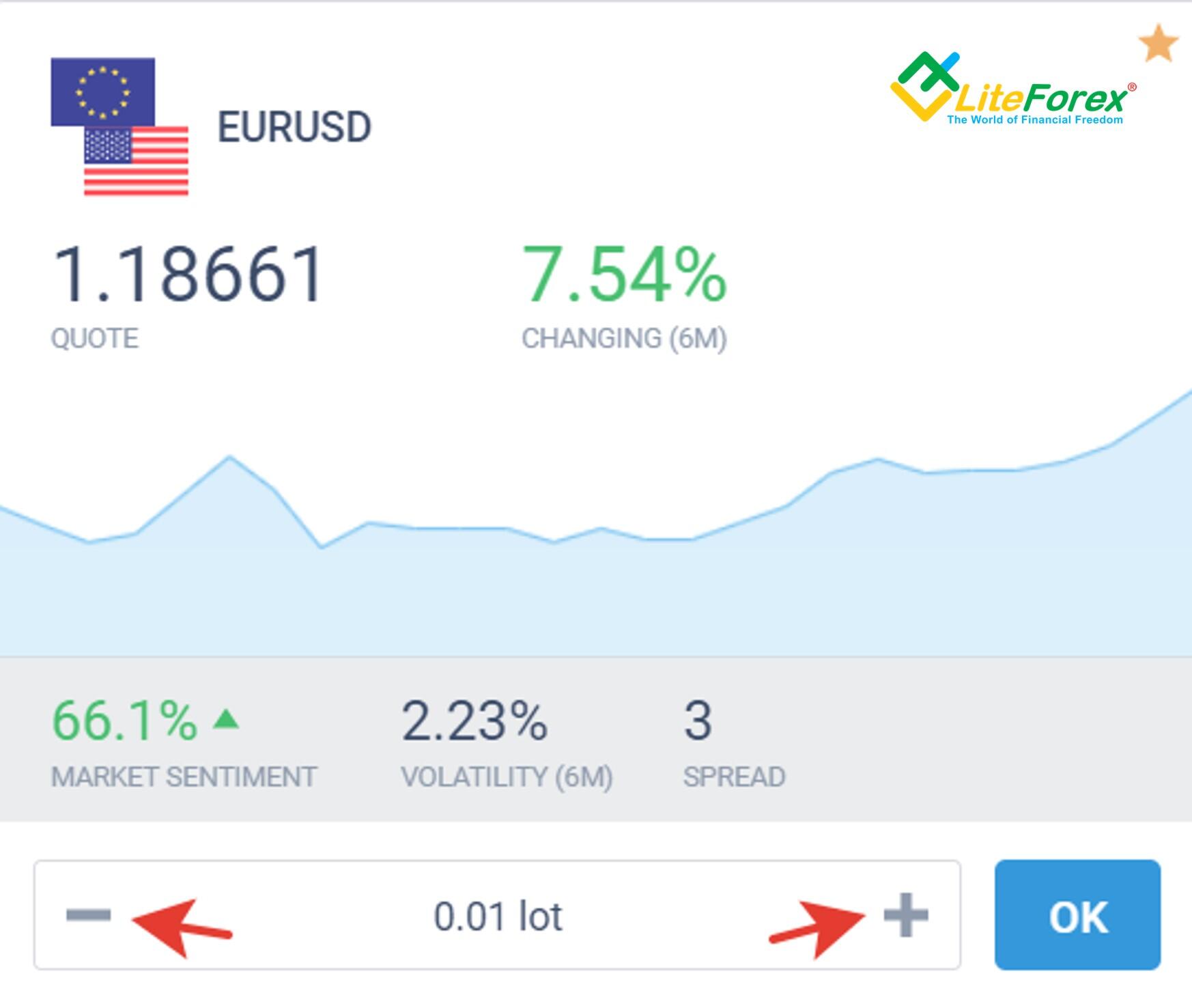

The trader sets the volume in contracts when opening a position. Its value can be from 0.01 to 100.

It is important for beginners on Forex to remember the connection between the concepts of forex lot size and leverage.

Leverage actually doesn’t affect the size of the contract and its price. However, the concept of leverage plays a significant role in determining the size of a trader's position. The greater the leverage, the more a trader can afford to buy or sell large lots in quantities that are many times greater than their own funds.

What are the pips?

Above we have discussed what lot and leverage are. The connecting link between these two concepts is a pip (short for percentage in point). It represents the minimum fraction of the change in the value of a trading instrument.

In other words, a pip is the standard smallest unit of measure by which a currency quote can change. On the foreign exchange market, 1 pip is usually equal to $0.00001 in pairs with the US dollar.

Oil and stocks, for example, have two characters after the decimal point. So the last (second after the decimal point) figure is a pip for these assets.

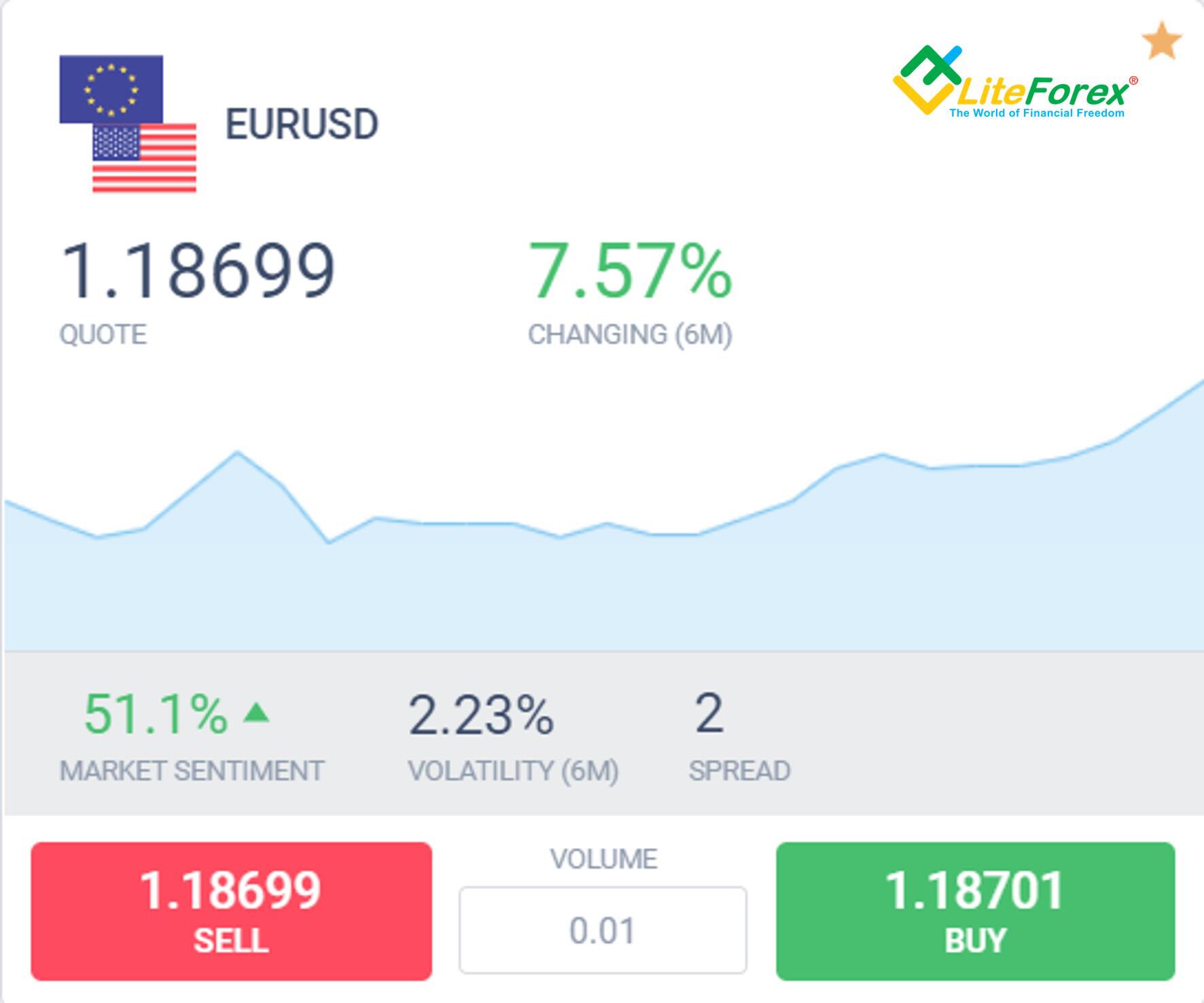

Let's look at the concept of a pip through an example. This way we can clearly see the relationship between lot size and leverage on Forex. Suppose we have a direct quote of EURUSD at 1.18699. This means that 1 Euro is worth 1.18699 USD.

If this quotation grew by one point (up to 1.18700), the value of 1 US dollar would decrease relative to the euro, since now you have to pay 0.00001 USD more for 1 euro.

Even 1 pip of price change has a direct impact on the final value of the trade.

The standard size of one contract for most brokers is 100,000 units. 1 unit of EURUSD will be equal to 1.18699 USD.

Example:

Suppose an investor buys 0.1 lots, hence the contract size will be $11,869.9 (100,000 * 0.1 * 1.18699). Suppose the exchange rate of this pair increases by one pip. Then the price of the contract of the same size will be equal to $11,870.0.

So the cost of 1 pip with a 0.1 contract will be equal to 0.1 USD.

An investor can buy much more with leverage. Suppose that our trader uses a 1:100 leverage and can increase the position by 100 times – they will not buy 0.1, but 10 lots. With such a large position, the cost of 1 pip will be 10 USD.

This example clearly shows how leverage affects the value of a pip through trade size. The more leverage, the larger position a trader can open. The larger the position, the higher the value of one point.

What is Lot Size

Now let's expand our knowledge of lot sizes. We mostly encounter four varieties.

Lot type | Number of units |

Standard | 100,000 |

Mini (1/10 of standard lot) | 10,000 |

Micro (1/100 of standard lot) | 1,000 |

Nano (1/1000 of standard lot) | 100 |

Standard lot is perhaps the most common type of contract on the Forex market and among brokers.

Mini lot is called fractional, it is equal to 1/10 of the standard lot size. It’s much less used than the standard lot. This type of contract is mostly used when trading contracts for cryptocurrency. Sometimes it can be encountered when trading on the metals market.

Micro lot is an even rarer on the Forex market. This fractional contract is more common among Forex brokers that provide access to CFD trading for cryptocurrencies and metals.

Nano lot is mostly found on the markets for raw materials, metals, and cryptocurrencies. This type of contract is extremely rare on the foreign exchange market.

Important! The size of one lot expressed in base units is usually not determined by the client, but by the requirements of the liquidity provider.

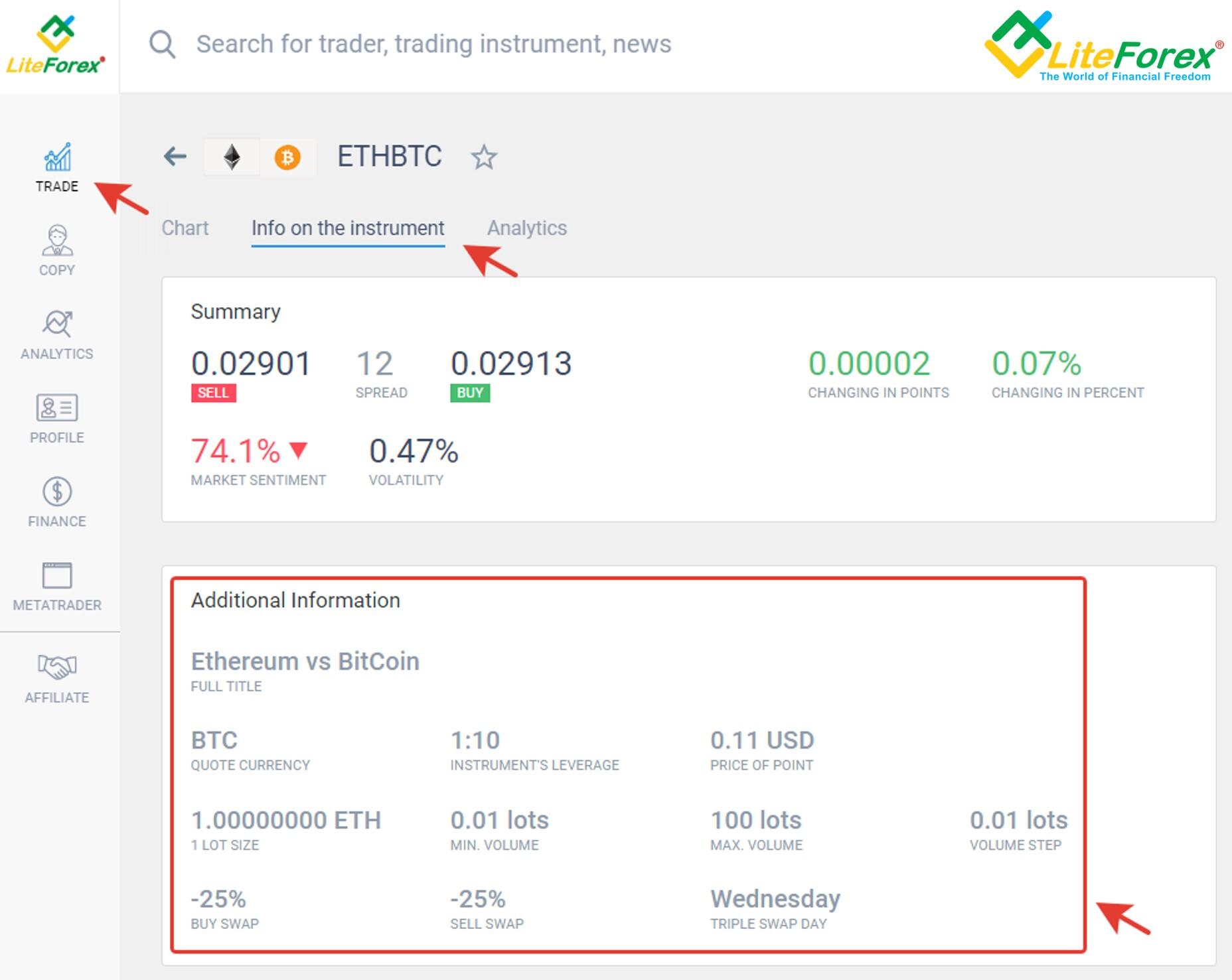

We can see through the example of LiteFinance that there are completely different lot sizes for different asset groups and types of trading instruments. LiteFinance uses a standard lot of 100,000 units for currency pairs and a nano lot for gold. If you look at the cryptocurrencies, LiteFinance offers its clients to trade Bitcoin and Ethereum in lots of only 1 unit! Detailed information on contract sizes for each trading instrument can be found here.

It should be remembered that the cost of a position depends not only on the number of units in the contract but also on the value of the underlying asset or currency in which these units are expressed.

In the example above, we counted 0.1 lots for the EURUSD pair as 10,000 euro units denominated in dollars. Other instruments are calculated by the same principle.

For example, a position in XAUUSD with a lot of 100 units will be equal to 100 troy ounces in US dollars.

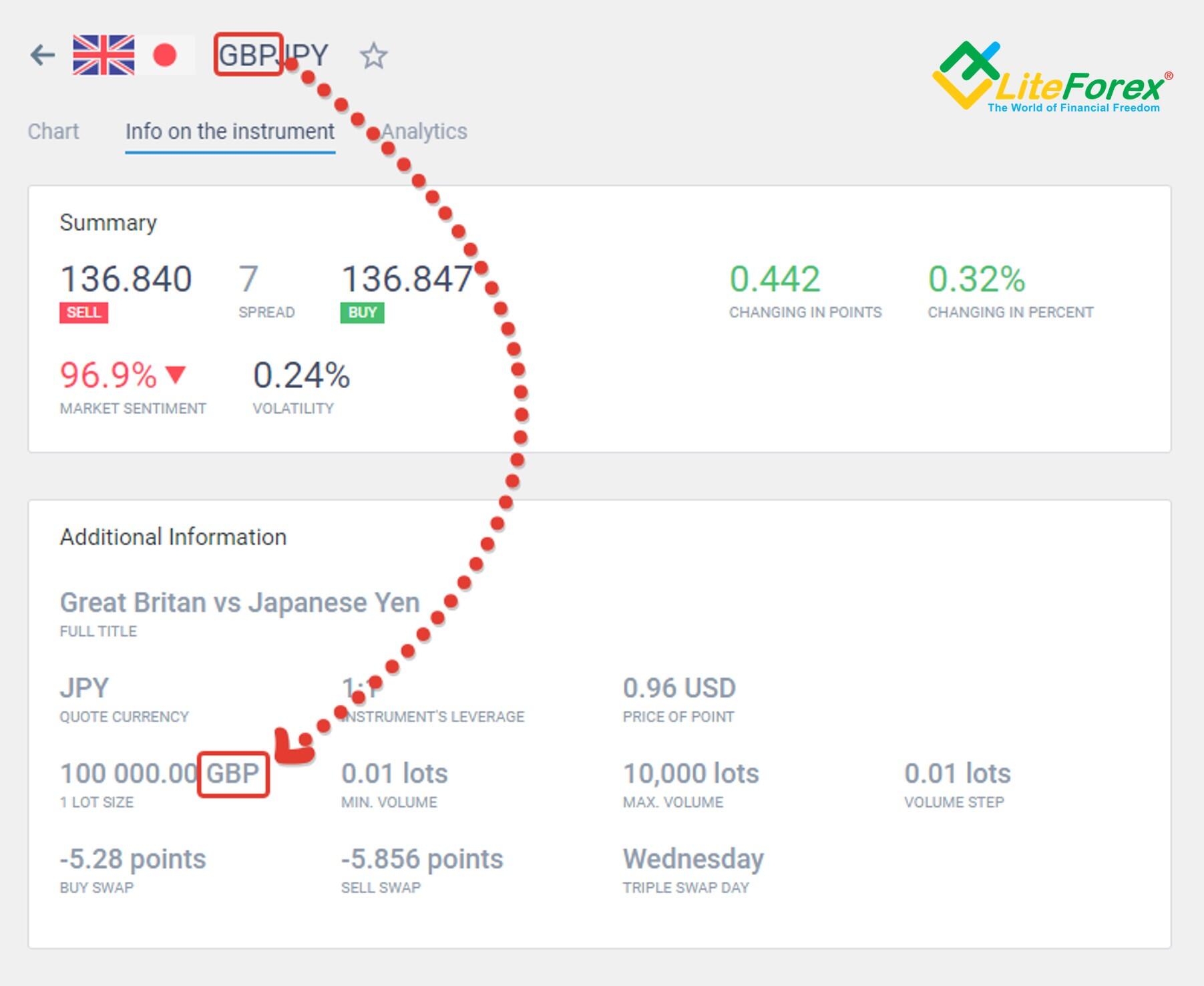

In the same way, for 1 GBPJPY contract equal to 100,000 units, the trade value will be 100,000 British pounds against the Japanese yen.

What does all this mean for the Forex market participant? Only that by buying cross rates (currency pairs that are not quoted against the US dollar), you are not only betting that the quoted instrument will grow, but also that the value of the quote currency will fall.

It is important for every trader and investor to know all the details of trading a specific instrument.

You can find the most detailed information about each asset in the trader's personal account. It’s accessible even without registration. To do this, go to the "Trade" section, select the desired trading instrument, click on "Instrument Information" and scroll down to the "Additional Information" widget.

In addition to information about the lot, you can see a lot of useful data there:

The cost of one pip when buying 1 contract for this instrument.

Quoted Currency - the monetary unit in which the quote price is expressed. It always comes second in the designation of the pair. So it’s pretty easy to identify. Stocks, oil, indices have no quotation currency in the name of the asset. You can find information on how the asset is denominated in the section “Information about Instrument”.

Base currency is the currency in which the contract price is expressed and which is traded in relation to the quoted currency.

Size of 1 lot and the currency it is expressed in for this asset. This currency is usually called the base currency.

Leverage set up on your account. If the broker has a leverage set for an asset in the form of % of the margin, you will also see the leverage it corresponds to.

The size of the buy and sell swap and the day of the triple swap. Swap is an overnight fee.

What is Leverage

Leverage is a concept very closely related to margin. It is a financial tool that allows traders to trade a much larger position than their own trading account size allows.

Example:

You have deposited 5,000 USD to your balance. You have chosen to use 1:20 leverage. Therefore, you can open positions for a total amount of 20 times your account = 100,000 USD.

Want to know more about leverage and how it works? Then read this complete beginner's guide here.

Differences & Relationship between Leverage and Lot Size in Forex

As we now know, leverage and lot size in Forex are different concepts.

Let's emphasize again: leverage does not affect the value of one contract. The standard contract in currency will be one hundred thousand units at any leverage.

However, leverage affects the amount of funds at the trader's disposal. In order to see how the size of the Forex lots and leverage affect the real value of the trade, let’s look at the calculation formulas with and without leverage.

With leverage, the trade value will be equal to the amount of margin.

So we see that the size of the contract is directly proportional to the value of the trade. This means with an increase in the size of the lot or its quantity, the value of the trade also increases.

The leverage ratio is inversely proportional to the value of the trade and with an increase in the amount of leverage, the value of the trade decreases.

Important: there are different recommendations for using leverage for different types of trading instruments, depending on the conditions of the liquidity provider the broker works with.

The LiteFinance broker uses leverage for metals, oil, indices, cryptocurrencies, and stocks. This is a decrease in the trade value by setting the percentage of the margin with. You can find this parameter in the specification of a trading instrument.

For currency pairs, the leverage is set by the trader.

So in order to open a position, depending on the asset, you need either a percentage of its actual value or the amount divided by the leverage set by the trader in their account settings:

Asset type | Margin percentage | Leverage |

Metals | 1% | 1:100 |

Palladium | n/a | Selected in account settings |

Oil | 10% | 1:10 |

Indices | 1% | 1:100 |

Stocks | 2% | 1:50 |

Currencies | n/a | Selected in account settings |

Cryptocurrencies | 10% | 1:10 |

Example of the relationship between leverage and lot for Forex pairs

For currency pairs, leverage is set by the trader on their trading account.

We open a position in the EURUSD for 1 lot.

To open 1 lot of EURUSD (buy 100 000 EUR) without leverage, a trader will need 118 748 USD.

Forex trading is margin trading and the trader has set a leverage of 1:1000.

So the amount of margin will be 1,000 times less than the actual value of the position.

To buy 100 000 EUR, a trader will need only 118.75 USD:

Example of the relationship between leverage and lot for metals

Leverage is used for all precious metals other than palladium.

Trading with a broker is margin trading, so leverage is applied to the open trade. The margin for opening a position is calculated by the formula:

The margin percentage (fixed amount) is the leverage provided by the broker when trading metals. LiteFinance has margin percentage equal to 1%.

How it works:

We open a position in the XAUUSD for 1 lot.

1 lot of gold is equal to 100 troy ounces.

In the US dollars, the value of this position will be 206 548 USD.

So the amount of margin will be only 1% of the actual value of the position.

It means a trader will need 2065.48 USD to buy 100 troy ounces of gold (1 lot):

Example of the relationship between leverage and lot for stocks

Leverage is used for stocks, just like for gold, which I mentioned in the example above.

The margin percentage for stocks with LiteFinance is 2%.

We open a position to buy 1 APPLE share through a broker.

The actual value of one #AAPL share is 449.20 USD.

The amount of the margin for opening this position will be 2% of the actual value, which is equal to 8.98 USD:

Leverage and lot size calculator

The formulas above may seem complicated. If you want to know how to calculate leverage and lot size as easy as possible and estimate the potential profit, here is the answer: you can use the leverage and lot size calculator.

Leverage Calculator

Use the lot size and leverage calculator below to calculate leverage and margin to open the position for different instruments. All you need to do is enter the values you need for the trade and click “Calculate”. A full calculation will appear below, including the amount of the margin.

What would be the required margin for 1 lot (100,000) eurusd, if your leverage is 1:100? Try to calculate here:

Summary

What is the difference between lot size and leverage? How are these two factors related to each other? If you’ve read this article, you now know the correct answers to these questions.

I have prepared a short version of this article for you with the most useful information and a summary of conclusions. Click here to download Forex Lot Size and Leverage PDF.

Although the amount of leverage does not affect the size of the contract itself, it increases the purchasing power of the account. It allows you to buy more lots and reduce the amount of margin. The size of the contract directly affects the volume of your position, and, therefore, its final value.

Remember:

The larger the position volume in lots, the larger your position in monetary terms.

The higher the leverage, the less margin you pay for opening positions with the same volume. Leverage expands the possible limits of your position without changing the amount actually deposited on the balance.

The information in this article will work best if you try to apply it in practice. Calculate the value of the trade manually and then using a calculator. This will allow you to understand leverage and size of the contract - the basics for every forex trader.

To get a deeper understanding, I recommend opening trades of different volumes on a demo account on the simplest and most convenient platform. A demo account is available here without registration, and you will see how the margin and current profit/loss differ depending on the value of the contract.

Also, here you can create several demo accounts with different leverage. It will allow you to see how lot size vs leverage correlate in practice.

Best regards,

Mikhail@Hypov

Leverage & Lot Size FAQ

To calculate the lots and leverage correctly, you need to use a convenient calculator. Fill in the leverage size and the contract volume. The online calculator will do all the work for you. You can also use the calculation tables in this pdf file.

To answer this question, you need to use a simple formula for calculating the margin = 1 lot * 100,000 EUR * price EURUSD / 100. So you will need 1,000 Euro or 1,000 Euro * EURUSD exchange rate to calculate the margin in the base currency.

To calculate this, you need to know the quoted price and the size of the contract. For example, for EURUSD, the value of 0.01 contract = 1.1757 (EURUSD quote) * 0.01 (lot size) * 100000 (1 lot EURUSD). Therefore, for EURUSD 0.01 lot will cost 1,175.7 USD.

The largest and most common size of one lot on Forex is 100,000 units of the base currency, and the largest number of open lots usually does not exceed 100 in one trade. Remember that the cost of a lot unit is equal to the quoted instrument. In other words, each contract unit for the AUDCAD pair will be equal to the Australian dollar unit, and for the CHFJPY pair - to the Swiss franc unit. Following this logic, you can come to the conclusion that the most expensive standard lot will be a contract for currency pairs with the British pound as the base currency, as it is the most expensive currency in the world.

Pip and lot are two different things. A pip is the smallest unit of measure for the dynamics of a quoted instrument. This term refers to price changes. 1 standard lot means 100,000 base units. This term refers to the volume of the trade.

The most popular leverage on Forex is 1:100. The largest is 1:1,000. Only bucket shops can offer more. Choosing the best leverage is an individual decision and depends on your balance, trading strategy and risk tolerance. For more information, read Best leverage on Forex.

P.S. Did you like my article? Share it in social networks: it will be the best "thank you" :)

Ask me questions and comment below. I'll be glad to answer your questions and give necessary explanations.

Useful links:

- I recommend trying to trade with a reliable broker here. The system allows you to trade by yourself or copy successful traders from all across the globe.

- Use my promo code BLOG for getting deposit bonus 50% on LiteFinance platform. Just enter this code in the appropriate field while depositing your trading account.

- Telegram chat for traders: https://t.me/litefinancebrokerchat. We are sharing the signals and trading experience

- Telegram channel with high-quality analytics, Forex reviews, training articles, and other useful things for traders https://t.me/litefinance

The content of this article reflects the author’s opinion and does not necessarily reflect the official position of LiteFinance. The material published on this page is provided for informational purposes only and should not be considered as the provision of investment advice for the purposes of Directive 2004/39/EC.