Dear friends!

In the previous article, I have finished covering the rules of retracement (relations of waves), which help you identify the positions of monowaves and complex wave formations in the Elliot wave patterns.

If you are not familiar with the NeoWave theory, I strongly recommend reading all the articles in the NeoWave series to learn about the most modern interpretation of the Elliott Wave theory, based on Glenn Neely’s book Mastering Elliott Wave, starting from the first one:

Neo Wave theory. Part 1. Rules for creating charts.

Neo Wave theory. Part 2. Basic information on Polywaves and Structure Labels.

NeoWave. Part 3. Retracement Rule 1.

NeoWave theory. Part 4. Retracement Rule 2.

NeoWave theory. Part 5. Retracement Rule 3.

NeoWave. Part 6. Retracement rule 4. Conditions “a” and “b”.

NeoWave. Part 7. Retracement rule 4. Conditions “c”, “d” and “e”.

NeoWave. Part 8. Retracement rule 5. Conditions “a” and “b”.

NeoWave. Part 9. Retracement rule 5. Retracement rule 6, condition “a”.

NeoWave. Part 10. Retracement Rule 6. Conditions “b”, “c”, and “d”.

NeoWave. Part 11. Retracement rule 7.

NeoWave theory by Glenn Neely. Impulse wave patterns. Rules of extension, equality, alternation, overlap rule. Rules of logic

This article, as well as a few next ones, will deal with the Elliott wave patterns, their variations, and essential construction rules. I will also cover the principles of how wave patterns are composed of monowaves and conditional construction rules.

Impulsions

I have briefly covered impulsive patterns in the second part of the NeoWave series. Now, I will explain them in more detail.

Remember, Impulsions are the patterns that obey the following rules:

Impulsive patterns are usually comprised of five individual segments that are labeled with numbers from 1 to 5 and meet the conditions of trending or terminal patterns. A trending pattern is a pattern whose projections of waves 2 and 4 don’t overlap. The terminal pattern is a wave pattern, where the projections of waves 2 and 4 overlap. I will cover these concepts in greater detail in the section devoted to the rules of overlapping.

Three of these segments must be unfolding in the same direction.

The second segment (wave) is progressing in the opposite direction relative to the first, but it doesn’t reach the starting point of the first wave.

The third segment (wave) should be longer than the second wave and can’t be the shortest among waves 1,3 and 5.

The fifth segment is almost always longer than the fourth wave and must be at least 38.2% of the fourth. If its length is from 38.2% to 100% (not including) of the fourth wave, the fifth wave is called failed.

If at least one of the rules is not met, a potential impulsion is more likely to be a correction.

Extension Rule

An extension (the longest wave in a wave sequence), which I already described in the articles devoted to Williams (here) and Prechter (here), is an essential element of impulse price patterns. Differently put, the presence (or absence) of an extension allows one to distinguish real impulse patterns from imitations that are corrections.

A wave is an extension if it is the longest wave is a sequence, and it should be at least 161.8% of the next longest wave. If this rule is not observed, note two important but rare exceptions:

When the third wave is the longest, but less than 161.8% of the first, and the fifth segment is shorter than the third, there is a small chance that the market is forming an extremely rare third-extension terminal impulsepattern variation.

When the first wave in a pattern is the longest, it mightbe slightly shorter than 161.8% of the third wave, but the third one will not end higher than 61.8% beyond the end of the first one, there is still a remote chance of an impulse pattern variation.

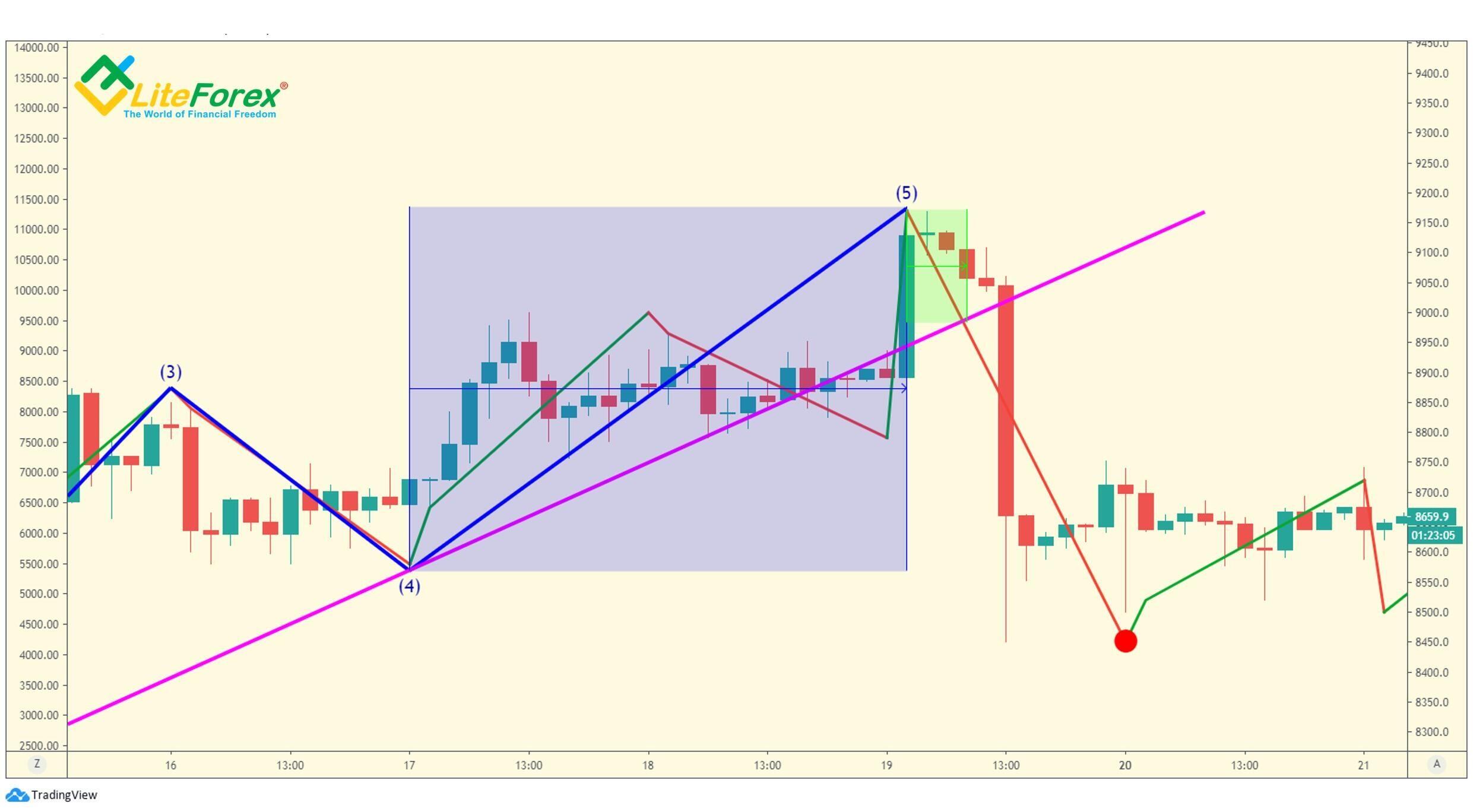

The chart displays a five-wave impulse pattern, whose waves are marked with numbers from (1) to (5). The third wave is the longest, but it is a little less than 161.8% of wave (1). Therefore, according to the exception of the extension rule, there is a remote possibility that a rare third-extension terminal impulse pattern is forming.

Rule of Equality

According to the Extension rule discussed above, one of the waves must be significantly longerthan the two other waves among waves 1,2, and 3. The opposite rule of equality refers to the other two waves. That is the two unextended waves should tend toward equality in price and/or time, or relate by a Fibonacci ratio (usually 61.8%) under either parameter or both. The rule may not work when a pattern contains a 1st wave extension or is a terminal impulse.

Let us look at our example. In the above chart, I compared waves (1) and (5), as the third wave is likely to be an extension. As you see, the fifth wave is almost 100% of the first wave, so the rule of equality works there.

Rule of Alternation

I have already covered this rule in the educational series devoted to the Elliot Wave Principle interpreted by Prechter (see here). In the NeoWave theory, the rule of equality states that “when adjacent or alternate waves of the same degree are compared, they should be distinctive and unique in as many ways as possible.” Unlike the theories offered by Williams and Prechter, which consider time and price coverage and the wave complexity, the NeoWave analyzes much more factors, in particular:

Price,

Time (time taken to form the wave, which Neely thinks a very important factor),

Intricacy (the number of sub-waves and monowaves present in a pattern),

Severity (the percentage of retracement of the preceding wave; it is applicable only to waves 2 and 4 of an Impulse pattern),

Construction (one pattern may be a flat, the other – a zigzag, and so on).

In impulse patterns, the rule of alternation is, first of all, applied to waves 2 and 4, in corrections – to waves A and B.

Let us see how the rule of alternation is applied to waves (2) and (4), studied in the first example of a five-wave pattern. These waves are marked by the green and pink areas in the chart above. Besides, the second wave has a more complicated structure than the fourth one. The second wave is also a flat pattern, and the fourth wave could be a zigzag if it had a more complex structure.

As for the severity, the second wave retraces the first wave by a little more than 38.2%.

The fourth wave retraces the third one a little less than by 38.2%. On this basis, we see an almost complete coincidence. However, in four other ways, the rule of alternation is observed.

Overlap Rule

The overlap rule applied in two different ways, depending on the type of impulse you are analyzing. In a terminal impulse, the price action zones of waves 2 and 4 should partially overlap. In a trending impulse, no part of wave 4 fall into the price range covered by wave 2. This rule is the easiest way to distinguish between these types of impulses.

In our example, the price action zones of waves (2) and (4) (the green and pink zones) do not overlap. So, this is a trending impulse pattern.

Summing up all the above, I once again stress that if the wave group being studied satisfies all the impulse rules, starting from basic ones to the overlap rule, this formation is likely to be an impulse; if one of the rules is violated, the pattern should be a correction.

Logic Rules

Over the years of close market observation, Neely has developed the Logic Rules. The rules of the logic state that all market action conforms to specific behavior based on the implications of the pattern which preceded it. These rules help one forecast the development of the market, and they are also a test to check if the market interpretation is correct. If the expected price action doesn’t occur, one must consider a scenario that the current market interpretation is wrong.

Two stages of impulse pattern confirmation

The first point to apply the Logic Rules is immediately after an Impulse pattern finishes.

1. Draw a trendline across the end of waves (2) and (4). To confirm whether the Impulse pattern you discovered is true, post-impulsive market action mustbreak the 2-4 trendline in the same amount of time consumed by the 5th wave or less. If it takes more time, wave-4 is not complete, or the 5th wave is developing into a terminal pattern, oryour impulse interpretation is wrong.

2. Identify which wave is the extension, and follow one of the below cases:

1st Wave Extension. The wave following this Impulse variation must reach the termination of wave 4. Sometimes, it will return to the price zone of wave 2. Besides:

a. This is the case when the 1st Extension is wave 1 or wave 5 of a larger Impulsive pattern.

b. If the 1st Extension is wave 3, price action (depending on conditions) may not be able to return to the 2nd wave zone.

c. If the market moves beyond the termination of wave 2, the whole impulse pattern ended an even larger impulsion or correction.

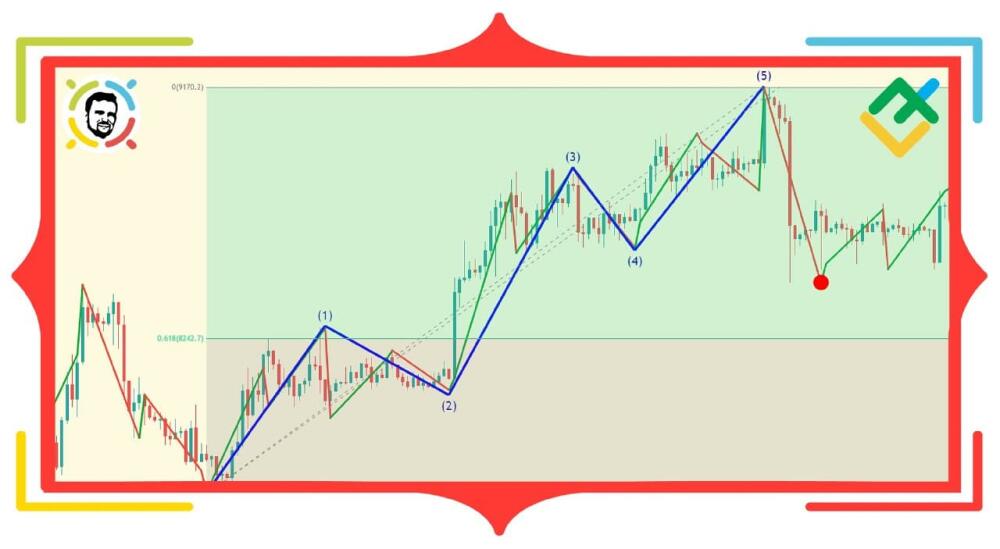

3rd Wave Extension. Price action mustreturn to the 4th wave zone of the completed impulse pattern and will usually end near the termination of wave 4. If the price movement retraces more than 61.8% of the entire pattern, the 3rd extension impulse also completes an impulse wave of a higher degree

5th Wave Extension. The correction to follow a 5th extension pattern mustretrace at least 61.8%of the 5th wave, but must not retrace the entire 5th wave if the trend is strong enough. If the 5th extension does get completely retraced, it indicates the extension terminated a larger trend. Here, two options are possible:

a. The 5th extension pattern is an element of a larger 5th extension impulse pattern.

b. The 5th extension impulse is a C-wave of a zigzag or a flat.

5th Wave Failure. A 5th wave Failure occurs when wave 5 is shorter than wave 4. The wave following the 5th failure impulse should completely retrace the entire impulse wave. If the impulse was moving upward (downward), there should be nonew highs (lows) in the market until the impulse is completely retraced. I will give an example of how an impulse pattern is confirmed.

I base on the previous chart where I connected the ends of wave 2 and wave 4 with a pink trend line. The above chart shows an enlarged picture of this situation so that you can better see that the period of time that has passed before the next wave breaks through this trend line is no longer than it took to form wave 5 (the green square is clearly smaller than the blue one in the chart). So, the first rule to confirm an impulse wave is observed.

Advanced Logic Rules

Neely devotes a separate section to the advanced logic rules, as they cover the trending and terminal impulsions separately.

Trending Impulse

Remember, a trending impulse is a pattern whose projections of waves 2 and 4 don’t overlap. The wave, following the trend impulse, shouldn’t completely retrace the impulse if the impulse pattern isn’t wave 5 of a larger impulse pattern or a C-wave in a correction.

If the following wave doesn’t retrace more than 61.8% of the Impulse wave, the trending impulse can be an a-wave in a correction, the first wave, or the third wave of a larger impulse pattern.

If the retracement of the previous impulse pattern exceeds 61.8% and the previous impulse pattern is wave 1 of the pattern of a larger degree, expect a complex (relative to wave 1) time consuming 2nd-wave correction to develop, which contains a c-wave failure.

If the completed impulse pattern is the third wave of a next larger pattern, whose fourth wave is about 61.8% of the third wave, there should be a 5th wave failure. Besides:

A 5th wave extension is expected when wave 4 recovers from the severe retracement of wave 3, and wave 3 is not more than 261.8% of wave 1.

Wave 4 is more complex and time-consuming than wave 2, and wave 4 concludes at a 61.8% retracement of wave 3.

3rd wave extension. If the wave following the 3rd wave extension doesn’t reach 61.8% of it, the 3rd wave extension is likely to conclude wave 1 or wave 3 of a larger pattern.

5th wave extension. A 5th wave Extension should not be completely retraced by the next move of the same Degree unless the 5th wave concluded wave-c of a Correction, but this is a rare case.

Terminal Impulse

The terminal impulse is a pattern where the projections of waves 2 and 4 overlap. The wave following the terminal impulse must retrace the entire pattern in 50% or less of the time consumed by the terminal pattern. Usually, it takes 25% of the time.

A terminal pattern always completes a larger formation and the high or low it creates should hold for approximately twice the time period (or more) covered by the terminal. If the terminal impulse is the 5th wave of an impulse pattern, the larger Impulse pattern also isusuallycompletely retraced.

Let us look at the example. We shall identify the impulse type: trending or terminal. It is clear from the chart above that the wave following the 3rd wave extension impulse (I marked the end of the impulse with the red circle) reaches the price zone of the fourth wave, it also finished close to the end of wave 4. So, the condition of the trending impulse is satisfied, and we shall apply all the properties of a trending pattern to the identification of the next pattern.

Besides, the wave following the impulse is less than 61.8% of it. So, according to the advanced logic rules, the impulse is likely to conclude wave 1 or wave 3 of a larger pattern. This is all for today, In the next article, I will cover progress labels and Fibonacci relationships typical for impulsions.

Take care of yourself and your money!

Subscribe and be the first to read the most up-to-date materials!

I wish you good luck and good profits!

P.S. Did you like my article? Share it in social networks: it will be the best "thank you" :)

Ask me questions and comment below. I'll be glad to answer your questions and give necessary explanations.

Useful links:

- I recommend trying to trade with a reliable broker here. The system allows you to trade by yourself or copy successful traders from all across the globe.

- Use my promo code BLOG for getting deposit bonus 50% on LiteFinance platform. Just enter this code in the appropriate field while depositing your trading account.

- Telegram chat for traders: https://t.me/litefinancebrokerchat. We are sharing the signals and trading experience

- Telegram channel with high-quality analytics, Forex reviews, training articles, and other useful things for traders https://t.me/litefinance

The content of this article reflects the author’s opinion and does not necessarily reflect the official position of LiteFinance. The material published on this page is provided for informational purposes only and should not be considered as the provision of investment advice for the purposes of Directive 2004/39/EC.